Afvc

Armed Forces Vacation Club (Afvc) offers all eligible members of the U.S. military vacations at an affordable price. Explore rental options in destinations worldwide, including $359 ($349 for Premium members) weeklong R&R stays (formerly known as Space-A). Free membership is one small way we thank you for your service. Afvc – Auftragsarbeitsvorgang – PP – SAP Tabelle. Tabelle Feldname Kurzbeschreibung Datenelement Feldtyp Feldlänge Prüftabelle Looking for online definition of Afvc or what AFVC stands for? AFVC is listed in the World’s largest and most authoritative dictionary database of abbreviations and acronyms AFVC is listed in the World’s largest and most authoritative dictionary database of abbreviations and acronyms AFVC is a standard SAP Table which is used to store Operation within an order data and is available within R/3 SAP systems depending on the version and release level. Below is the standard documentation available and a few details of the fields which make up this Table. You can view further information about SAP AFVC Table and the data within it using relevant transactions such as SAP ABAP Table AFVC (Operation within an order) – SAP Datasheet – The Best Online SAP Object Repository Willkommen beim American Football und Cheerleading Verband Baden-Württemberg e. V. Lernen Sie uns kennen Willkommen beim American Football und Cheerleading Verband Baden-Württemberg e. V. Lernen Sie uns kennen Willkommen beim American Football und Cheerleading Verband Baden-Württemberg e. V. Lernen Sie uns kennen Willkommen beim American Football und .

AFVC – HORN. Amateur Film & Video Club HORN. VÖFA Mitglied seit 1966 Klubabend jeden Mittwoch 19 Uhr – Bahnstraße 10. A 3580 HORN Bahnstrasse 10Tel.: 02982/38013 E-Mail:afvc-horn@aon.at Obmann:Erwin Luser E-Mail: erwin@luser.at Der wöchentliche Treffpunkt für alle Film&Video Interessierten! Open up a world of affordable vacation options for you and your family through Armed Forces Vacation Club (AFVC). Free membership is one small way we thank you for your service. Standard AFVC membership is always free. However, upgrading to Premium unlocks discounts that can make vacationing even more affordable. Upgrade today and start planning for more R&R with loved ones because extra .

Grupo Desportivo e Cultural do Neiva 10 Jornada AFVC

Hampton PT AFVC Speed Reducer Unit 56 HP Output Rpm 350

Ecomodelismo AAVC7C1 wresin upgrade parts

Ecomodelismo M113 ACAV

Ecomodelismo M113 ACAV

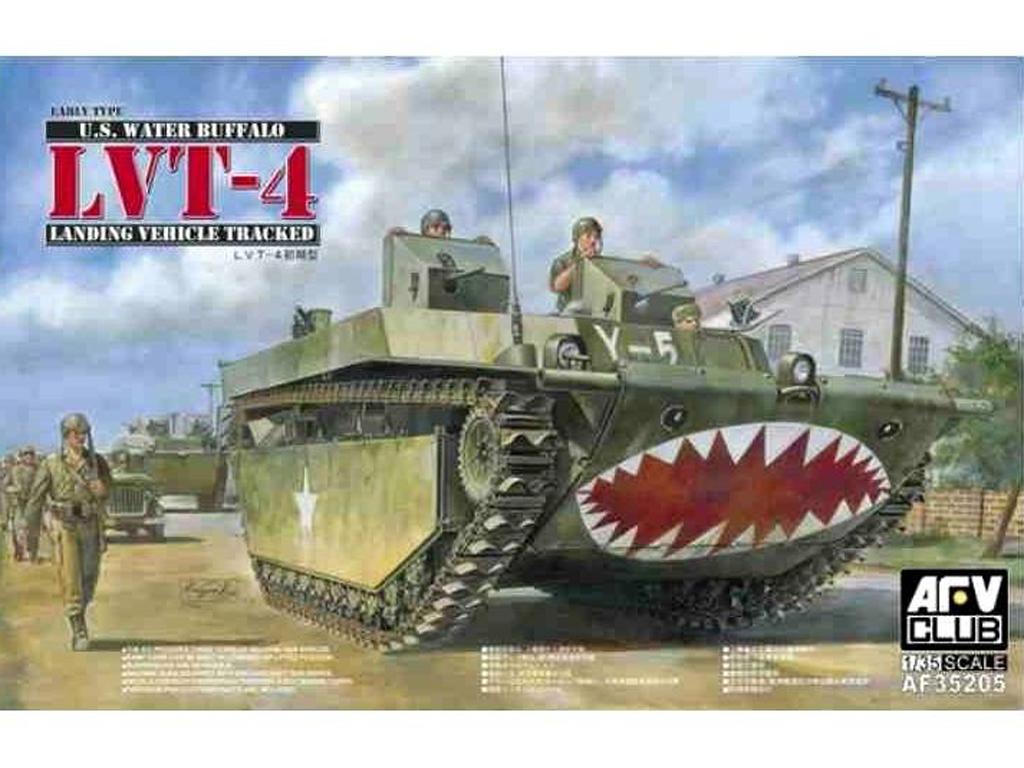

Ecomodelismo LVT4 Water Buffalo

Ecomodelismo AAVC7C1 wresin upgrade parts

AFVC SdKfz 231 rear turret hatch Armored vehicles

Ecomodelismo AAVC7C1 wresin upgrade parts

Ecomodelismo IDF M113 Nagmash

Ecomodelismo Rommels Mammoth DAKAEC

Ecomodelismo German Flakpanzer M42A1

Ecomodelismo German Flakpanzer M42A1

Ecomodelismo IDF M113 Nagmash

Ecomodelismo M60A3 Patton TTS

AFVC Vianense cumpre servios mnimos e vence Chaf

NRLCAAFVC

AFV Club 135 AF35254 M728 Combat Engineer Vehicle

Ecomodelismo LVTH6A1 Fire Support Veh w105mm Howitzer

Ecomodelismo LVTH6A1 Fire Support Veh w105mm Howitzer

AFVC Protect Cam Test Report NII DFS Ubiquiti Networks

Belum ada Komentar untuk "Afvc"

Posting Komentar