Disney Trip Planner

Discover recommended tips for planning your trip to Walt Disney World Resort near Orlando, Florida. See where to find information about vacation packages, parks, attractions, Resort hotels and dining. Learn how to manage all your vacation details—including tickets, reservations and more—on your My Plans page. If you are planning a trip to Disney World, get the inside skinny before you go. Disney World is a great place, but it can also be overwhelming trying to decide where to stay, what to see, or even what can you afford. Here’s some information to help you make informed choices. When to Go . If you are planning to visit Disney World on vacation, one of the first decisions you need to make is when Build a dream trip to the Disneyland Resort that fits your family’s preferences and budget. Book Your Vacation Package. Trip Planning Made Easy. Enjoy all the happiness of classic Disneyland Park and Disney California Adventure Park—which includes the revved-up and “tire”-ific Cars Land and the Downtown Disney District. Stay close to the magic at Disneyland Resort Hotels or nearby Good A Disney Travel Planner’s Depth of Knowledge. This one is especially important if you are going to Disney World for the first or second time. Since Disney is a massive theme park – filled will all sorts of parks, attractions, resorts, restaurants, entertainment, and transportation options – then you really need someone who can help you plan and navigate through every step of your trip Planning Your Disney World Vacation. Planning a trip to Walt Disney World is a daunting task even for repeat visitors. We’ll make your trip planning as easy as possible with our step-by-step guides and easy-to-use tools, saving time and money every step of the way. Step 1: Deciding when to visit Now, you’ve booked your trip, and it’s time to start planning your time at Walt Disney World. Packing for Walt Disney World. Rather than an extensive packing list, we offer simply 10 items we always forget to pack for our Disney trips. These are ten things you might not find on every other list if you Google “Disney World packing list”. .

If you’re planning a trip to Disneyland, you’ve come to the right place! In this guide, we cover everything from flights to hotels to riding all the best rides. We’ve even got the newest on the opening of Galaxy’s Edge! So grab a cup of coffee (or tea, or water), settle in, and let’s start planning your trip to Disneyland! Contents. Basics of Disneyland Resort. Dates, Events, and If your plans change, any Disney-imposed change and cancellation fees will be waived up to the date of check-in for reservations with arrivals through December 31, 2020. Learn more about this flexible policy. Explore important updates to the Disney Resort hotel experience, including the proposed phased re-opening schedule. Discover Magical Extras. When you book a room and ticket package, you Find inspiring Disney vacation ideas and embark on a trip of a lifetime. Whether you visit Disneyland Resort, Walt Disney World Resort or take to the sea on our Disney Cruise Line—explore ideas to plan your upcoming getaway. Disney Planner + Travel Guide – Walt Disney World Vacation Planner – 80 pages of Disney planning info & templates with FREE updates BibbidiBobbidiBi. From shop BibbidiBobbidiBi. 5 out of 5 stars (71) 71 reviews $ 19.38. Favorite Add to .

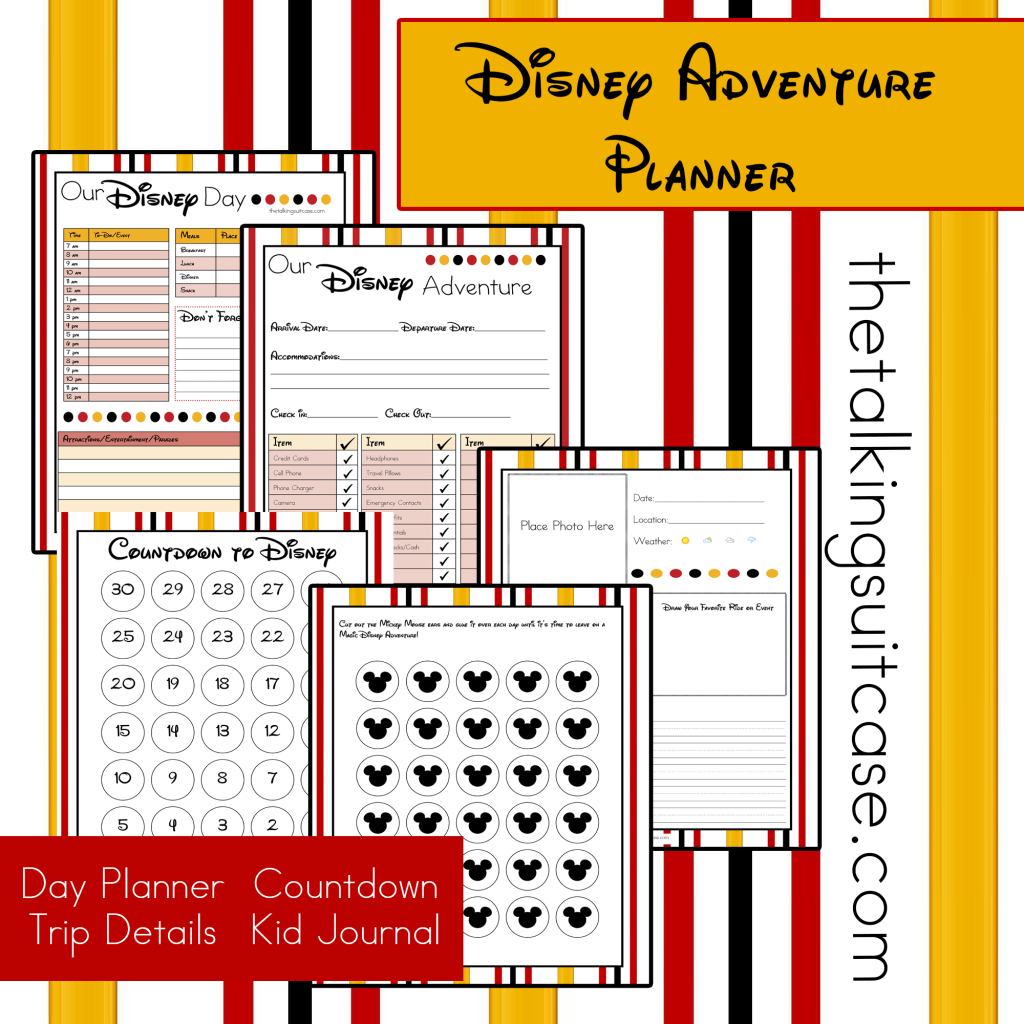

Free Printable Disney Vacation Planner Disney vacations

Are you planning a trip to Disney soon If so come

Ultimate Walt Disney World Vacation Planner Dream Plan Fly

Get Ready For Your Disney Vacation Free Printable Disney

Ultimate Walt Disney World Vacation Planner A5 Size

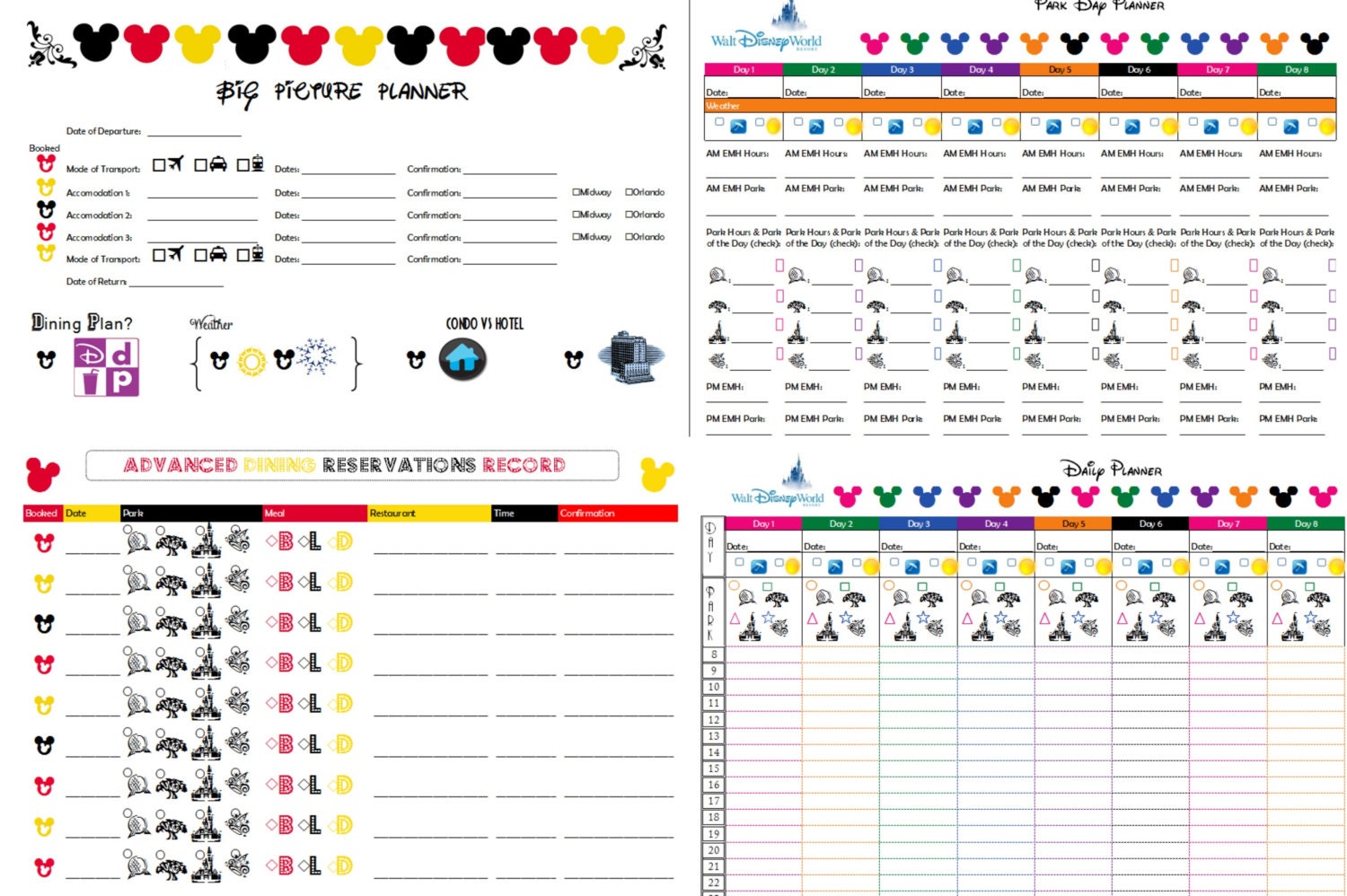

Disney World Trip Planner Binder Starter Set for 9 Day Trip

Ultimate Walt Disney World Vacation Planner Dream Plan Fly

DisneyLand Trip Planner Binder Starter Set for 9 Day

Orlando Walt Disney World Vacation Planner Free Printable

Free Disney World Planner Printables Edutaining Adventures

Disney World Trip Planner Binder Printable

Walt Disney World Travel Info Planner Dream Plan Fly

Summer Vacation Destinations with a Focus on Families

vacation planning printables Google Search Itinerary

Free Disney World Planner Printables Disney vacation

Disney World Disneyland Vacation Planner Kit Editable

Walt Disney World Trip Planning Binder Disney world

FREE Disney Cruise Planner Disney vacations Cruises and

Disney World FREE Planning Printables Disney World

ULTIMATE Bundle Planner Pack 42 Pages Disney World Trip

Ultimate Disney Planning Kit Printable Disney

Belum ada Komentar untuk "Disney Trip Planner"

Posting Komentar