Pleasant Hawaiian Holidays

For over 60 years, Pleasant Hawaiian Holidays has brought lovers, adventurers and sun worshippers to the beaches of Hawaii. Catch a wave on the North Shore. See the Green Flash. Watch the sunrise from the rim of Diamond Head Crater. Like no other place in the world – this is the real Hawaii. Pleasant Holidays offers vacation packages and travel packages to destinations worldwide including Caribbean, Hawaii, Mexico, Tahiti, Europe, Asia and more. Book a Hawaii vacation package with the Hawaii experts at Pleasant Holidays! Many Hawaii travel packages include free meals and free stays for kids which makes for great Hawaii family vacations and more. Book a Hawaiian Island package to Oahu, Maui, Kauai and Big Island and save today! Oahu Vacations. One of the most iconic views of paradise is Diamond Head on Hawaii’s magical island of Oahu. Fittingly known as “The Gathering Place,” Oahu offers an abundance of riches ripe for exploration on your next Hawaiian holiday, from bustling Waikiki beaches, distinctive restaurants, and colorful shops to towering cliffs and verdant rainforests. Pleasant Holidays > Destinations > Hawaii Hawaii Vacations & Travel. Overview; Travel Information; Hotels; Hawaii Vacations . Discover the beauty, culture and cuisine of the Hawaiian Islands. There are six major islands to visit in Hawaii: Oahu, Maui, Kaua’i, Island of Hawaii, Lanai and Molokai. Each island has its own unique personality, adventures and attractions offering different Pleasant Holidays has sent more than 10 million visitors to Hawaii since 1959, featuring value-packed vacations, customized itineraries and nationwide airfares; plus a large variety of activities and excursions for a truly memorable experience. For the ideal Hawaii travel experience, travelers can select a vacation that includes multiple islands. Pleasant Holidays and Journese, the luxury .

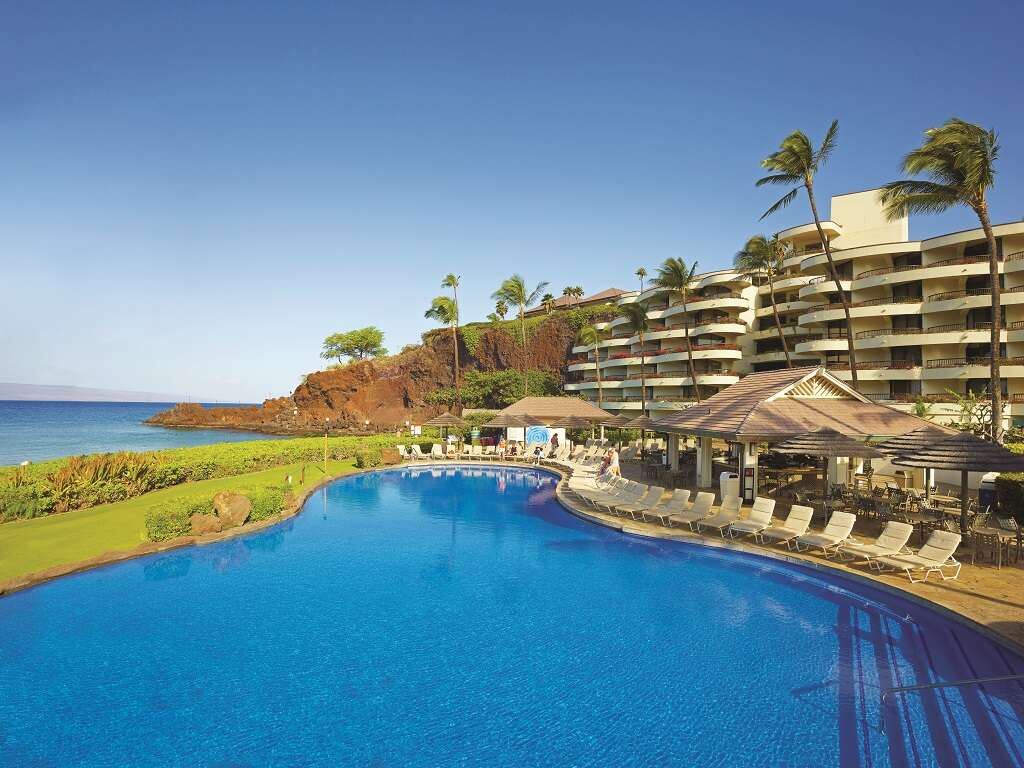

Pleasant Hawaiian Holidays. 297 likes · 2 talking about this. Since 1959, Pleasant Hawaiian Holidays has offered vacation packages to Oahu, Maui, Kauai, Island of Hawaii, and the outer islands! Maui offers over 30 miles of accessible beaches, much more than the other Hawaiian Islands. The friendly town of Lahaina, a former fishing village and the original capital of the Kingdom of Hawaii, is an oasis along the island’s western shores. Roam its many art galleries, pubs, and eclectic shops. Explore the area’s unique history, from whaling to missionaries, via the Lahaina Historic Trail. .

Pleasant Holidays Adds Kauai Marriott Resort to Collection

Pleasant Holidays Makes Hawaii Summer Vacations Easy

Pleasant Holidays Launches 2017 2018 Hawaii Vacation

The Top Hawaiian Resorts with Pleasant Holidays

2019 Hawaii Vacation Deals Recommend

The Top Hawaiian Resorts with Pleasant Holidays

Pleasant Holidays

Pleasant Holidays Hawaii Hot Deals Exclusive

Pleasant Holidays Announces Biggest Deals on 2018 Hawaii

Pleasant Holidays Exclusive offers at Sheraton Maui

Travelers Save Big With Pleasant Holidays New Hawaii

Pleasant Holidays Fall Travel Sale Features 500 Savings

Pleasant Holidays Offers BOGO Hawaii Activity Sale Recommend

Escape To Hawaii With Pleasant Holidays

Escape the Winter Chill with Hawaii Vacation Savings from

Pleasant Holidays SAVE 20 PLUS receive a breakfast for

EXTRA Breaking Deals Hawaii 7Day SaleThe Worlds

Upgrades to Pleasant Holidays Journese websites include

Everything a Maui Vacation Should Be and Morefor LessThe

Hawaii Be Happier Pleasant Hawaiian Holidays Pin Pinback

The Cultural History of Hawaii HistoryCram

Belum ada Komentar untuk "Pleasant Hawaiian Holidays"

Posting Komentar