Timeshares

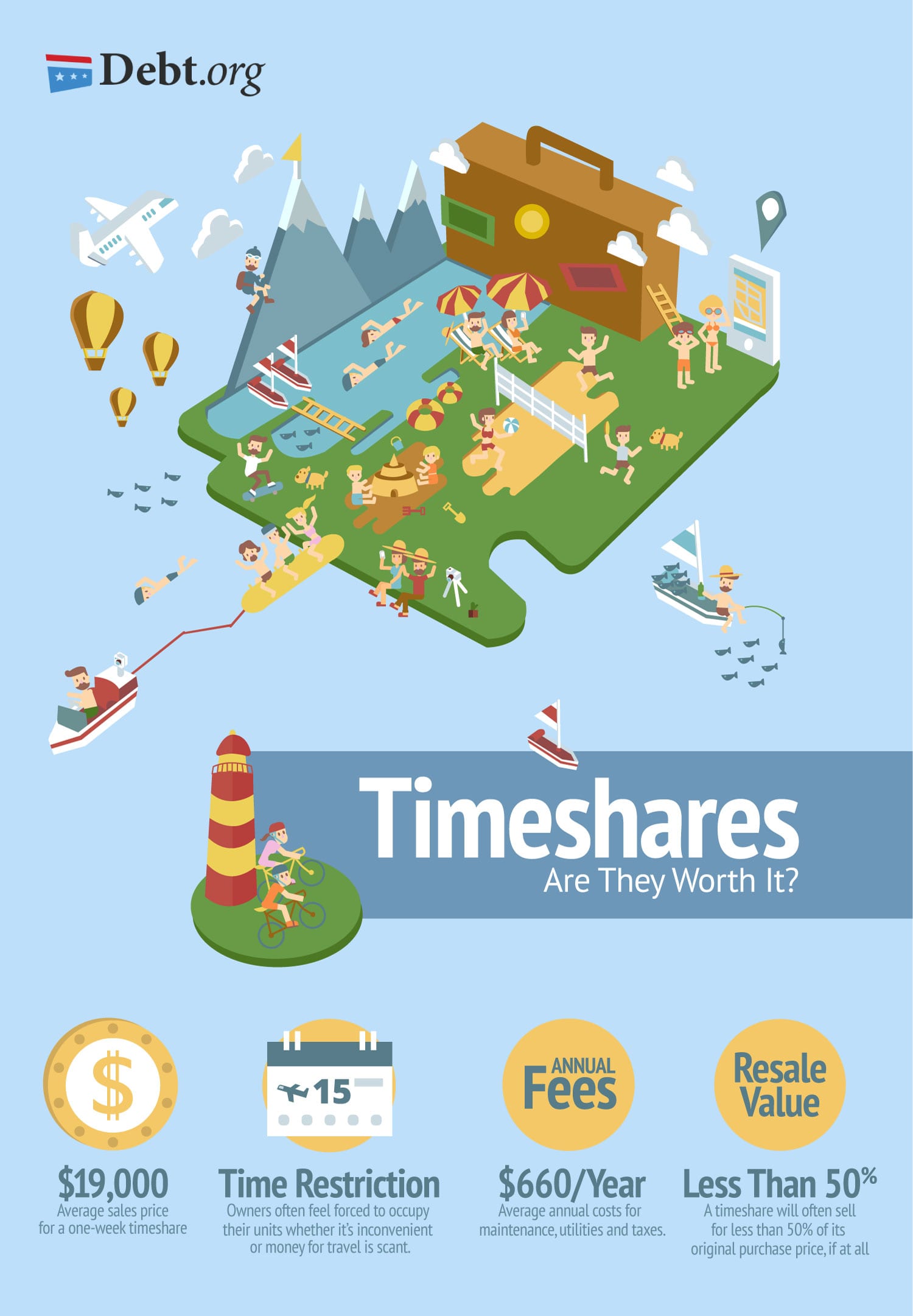

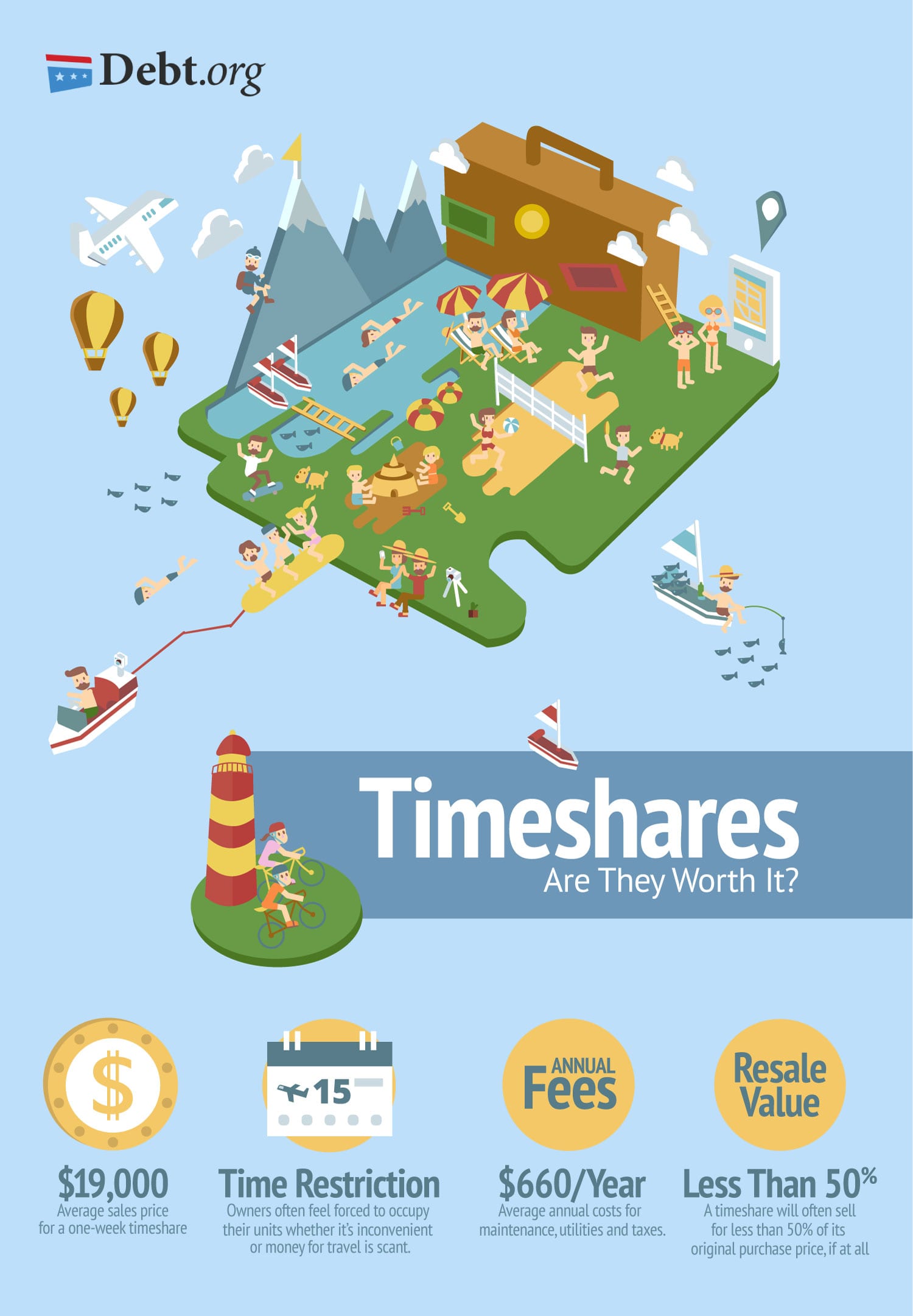

A timeshare (sometimes called vacation ownership) is a property with a divided form of ownership or use rights. These properties are typically resort condominium units, in which multiple parties hold rights to use the property, and each owner of the same accommodation is allotted their period of time. Unter Ferienwohnrecht (auch Timesharing, Teilzeitwohnrecht, Teilzeiteigentum, Teilnutzungsrecht, Wohnnutzungsrecht) sind Angebote im Hotel- und Touristikbereich zusammengefasst, durch die ein Verbraucher gegen Zahlung eines Gesamtpreises das Recht erwirbt, für die Dauer von mehr als einem Jahr eine Unterkunft für einen bestimmten Zeitraum des Jahres zu nutzen. Ein paar Wochen Ferien im eigens reservierten Appartment auf Mallorca – das klingt besser als es ist. Für ein langjähriges Feriennutzungsrecht auf Time-Sharing-Basis greifen die meisten tief in die Tasche. But is timeshare ownership really all it’s cracked up to be? We’ll show you everything you need to know about Timeshares so you can still enjoy your hard-earned money and time off. What Is a Timeshare? A timeshare is a vacation property arrangement that lets you share the property cost with others in order to guarantee time at the property. But what they don’t mention are the growing maintenance fees and other incidental costs each year that can make owning one unbearable. Timeshares For many people, enjoying the benefits of Timeshares begins by taking a fresh look at all the ways vacation ownership can enhance vacationing while helping control your costs. As a business model, timeshare is a simple concept: people jointly own shared interest in vacation property, reducing the ownership expense and on-going responsibilities for all involved. Time-Sharing war der erste konzeptionelle Ansatz in der Computertechnologie, mehrere Benutzer an einem Computer gleichzeitig arbeiten zu lassen (Mehrbenutzersystem), indem sie sich die Rechenzeit des einzigen vorhandenen Prozessors teilten. Jedem einzelnen Benutzer erschien es dabei so, als hätte er die gesamten Ressourcen des Computers stets für sich allein zur Verfügung. .

dict.cc | Übersetzungen für ‘time share’ im Englisch-Deutsch-Wörterbuch, mit echten Sprachaufnahmen, Illustrationen, Beugungsformen, Time-Sharing bezeichnet: . im Hotel- und Touristikbereich eine zeitanteilige Nutzung einer Wohneinheit in einer Ferienanlage, siehe Ferienwohnrecht; Time-Sharing (Informatik), ein Verfahren, um mehrere Benutzer an einem Computer quasi gleichzeitig arbeiten zu lassen Siehe auch: Diese Seite wurde zuletzt am 14. März 2019 um 18:28 Uhr bearbeitet. Stop the endless cycle of unwanted payments and rising maintenance fees. Legal timeshare cancellation is easier in 2018 than it used to be. Many resorts have opened “take-back” programs that allow distressed timeshare owners to give their timeshare back to the resort developer. RCI offers points and weeks’ timeshare owners member-only travel access and discounts for hotels, resorts, car rentals, cruises and more. Say hello to your every-trip travel source. .

Are Timeshares a Good Investment or a Scam

Top 5 Most Luxurious Timeshares for a HighEnd Escape

4 Reasons to Consider a Timeshare Rental for your Next

A Helpful Guide to Getting You Out of a Timeshare Deal

Are Timeshares Worth it Your Complete Guide My

Top Timeshare Resale Company Timeshares Only

Timeshare Classifieds Timeshares for Sale Sell a

Hotels vs Timeshares Why Hotels Are the Cheaper Option

A Short Comparison of Timeshare Companies Estilo Tendances

Timeshare Resales Versus Timeshares Offered by Developers

Timeshares 101 the basics of timesharing and is it for you

Timeshares Florida Smart

The Importance of Placing Your Timeshares Into A Trust

Premier Timeshare Resale Home

Timeshares for Sale 5 Reasons to Just Say No

Should I Take Hyatt Up On Their Timeshare Offer Points

Key West Timeshares For Sale

Top Timeshare Resale Company Timeshares Only

Westin Timeshares for Sale and Resale Advantage Vacation

One Napili Way Lahaina Hawaii Timeshare Resort RedWeek

Top Timeshare Resale Company Timeshares Only

Belum ada Komentar untuk "Timeshares"

Posting Komentar