Travel Itinerary Planner

Use our free trip planner to get a personalized day by day itinerary for your vacation. Inspirock is the new way to plan your holiday. Inspiration to see the planet. Profile. My account; Log out; Log in; Start planning; 1,208 trips planned today. 4.6. out of 5. Trustscore rating. The new way to plan your next trip Create a fully customized day by day itinerary for free. Itinerary planner + Add Visual algorithmic trip planner lets you choose destinations you want to travel to. You have the freedom to choose the real dates from the calendar. After selecting travel dates, planner runs algorithms to optimize a trip. It starts suggesting activities, sightseeing spots, tours and transport options with the details. For every attraction, it suggests open/close timings, time to spend, and nearby restaurants. No matter where you’re going, a Travel Itinerary Planner helps organize all the details of your trip. Whether you’re packing your suitcase for a vacation or a business trip, plan ahead with our free Itinerary Planner PDF Template. All you need to do is fill out a short form with information about your upcoming trip, and this Itinerary Planner Template will automatically create a professional PDF listing every item in your to-do list. In just one click you can download your itinerary A flexible platform for organizing your travel details. Gather plans, build itineraries, and share with others. Now, everyone gets to #travellikejess with a personal travel planner. Jess.travel is not just a person. It’s the idea that a custom travel itinerary should maximize your time by tying together “happy moments” in new places. Your time is valuable. Let me handle all the details. Have me create a personal travel itinerary for you today. With Triptile you can plan your trip to Europe just like you want it. Select from over 400 of European destinations, 300 template programs which can be modified just like you want them and from over 3000 activities hand-picked for each destination by expert travel planners to build your perfect European tour program. Triptile gives you control and the freedom to travel to Europe just like you want. Our Europe tour planner is unique and is the most powerful tool out there, which was .

The best trip planner apps can help you answer those questions. I’ve found several that will help you discover the right places to go and organize your day-by-day itinerary in one handy place. The best part is that it is organized by day, so it’s more of a daily trip itinerary planner, and you can edit the columns to include whatever “header” you want. This is made by a blogger who travels. She uses it to plan all her travels and it’s a substitute for a electronic itinerary template that you use on your phone. You’ll get instructions on how to fill it out. It’s a PDF itinerary format so that means you can print it and fill it out by hand or edit your trip details on a One reason many people travel is for business. We know a business trip is usually financed and accounted for by the company being represented. So it is important that you have a business travel itinerary detailing the plans for the trip. A business itinerary is a schedule of tasks to be accomplished within a designated […] Plan your next road trip route with Roadtrippers. Enter where you want to start and finish your road trip, and then discover the coolest “off the beaten path” places along the way. Our database includes millions of the world’s most fascinating places, making planning the unexpected easier than you thought. Road trip route planning can be tedious… and what do you get from it? Most of what you find online will funnel you into the same places, filled with other travelers. It can feel .

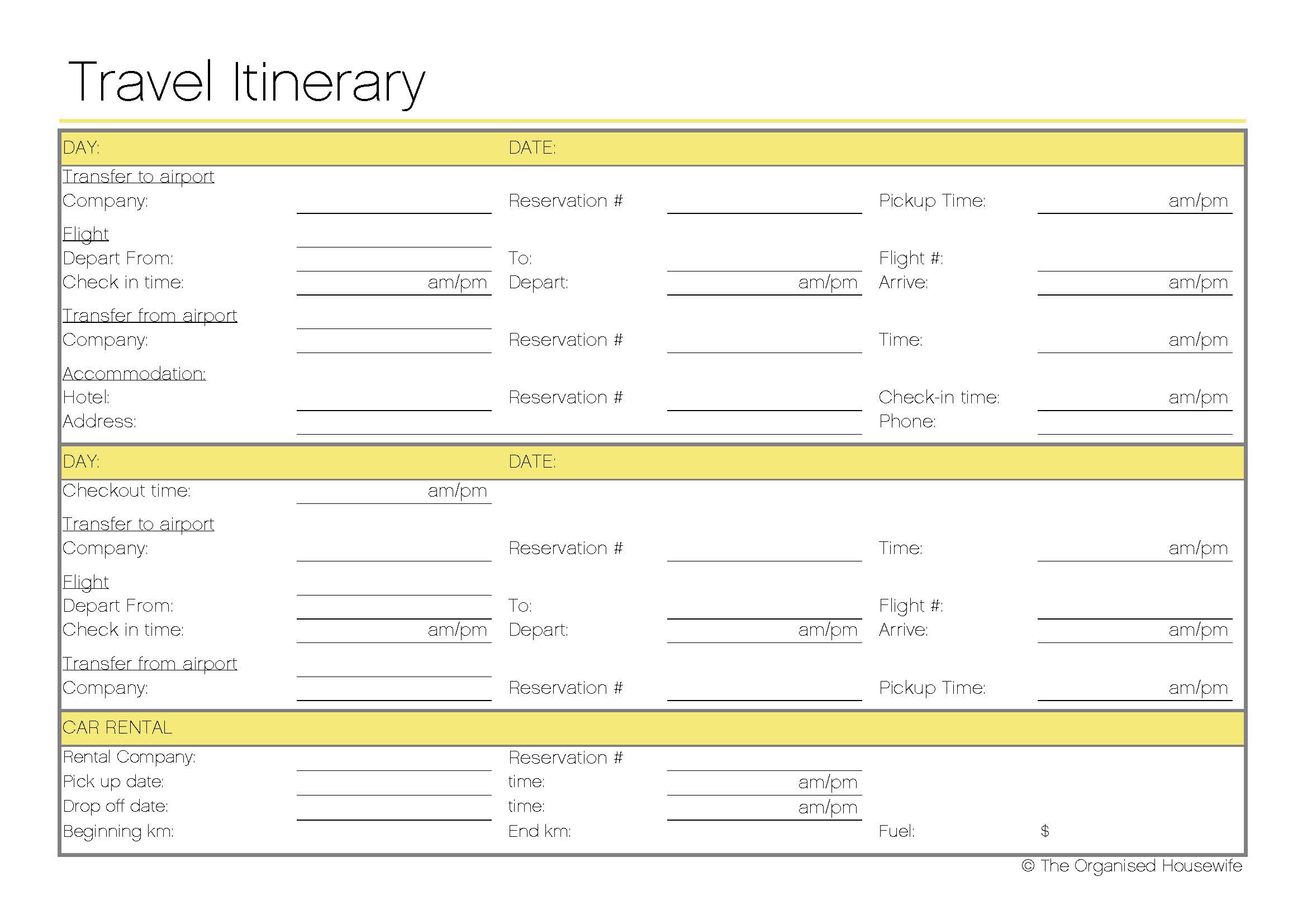

Download Printable Travel Itinerary PDF

Free Printable Travel Itinerary The Organised Housewife

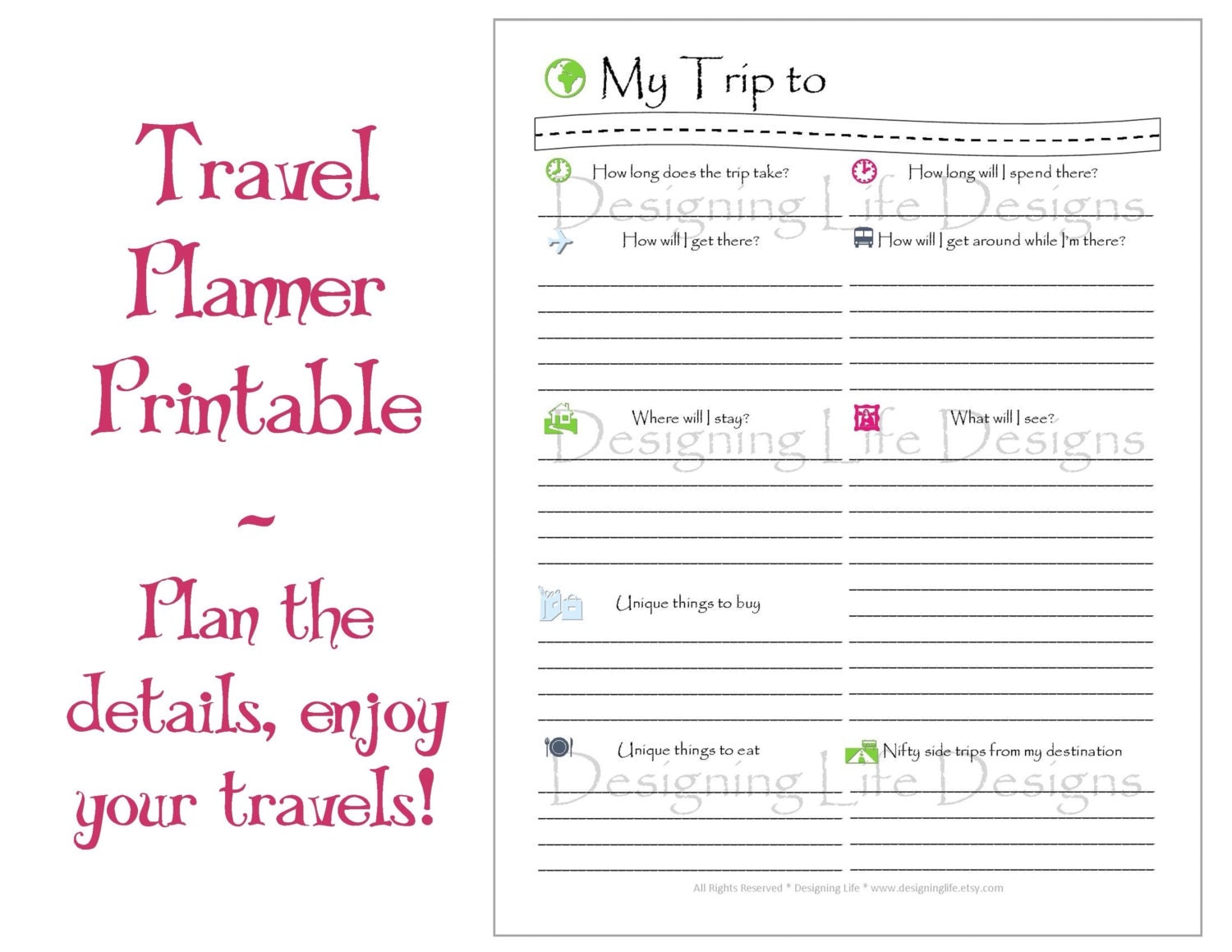

Free Printable Travel Planner Travel itinerary template

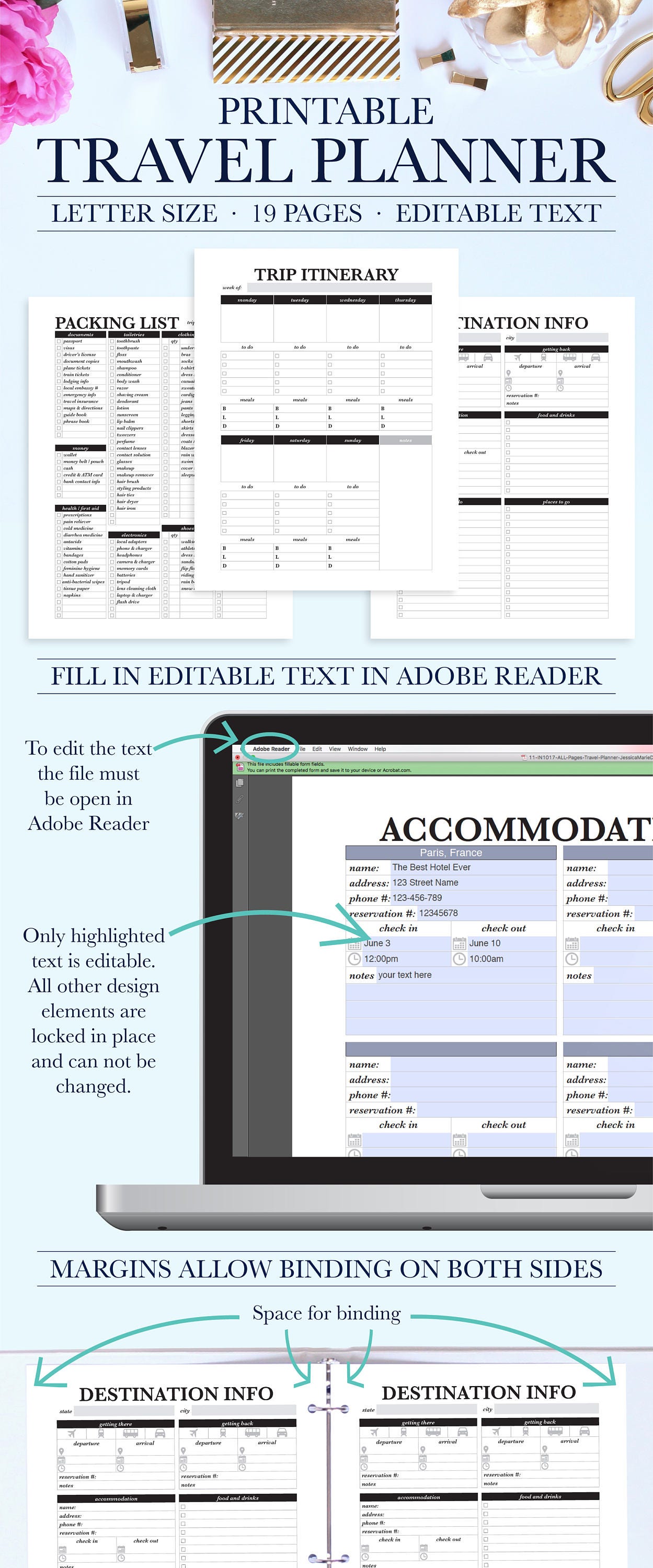

Printable Travel Itinerary shop fresh

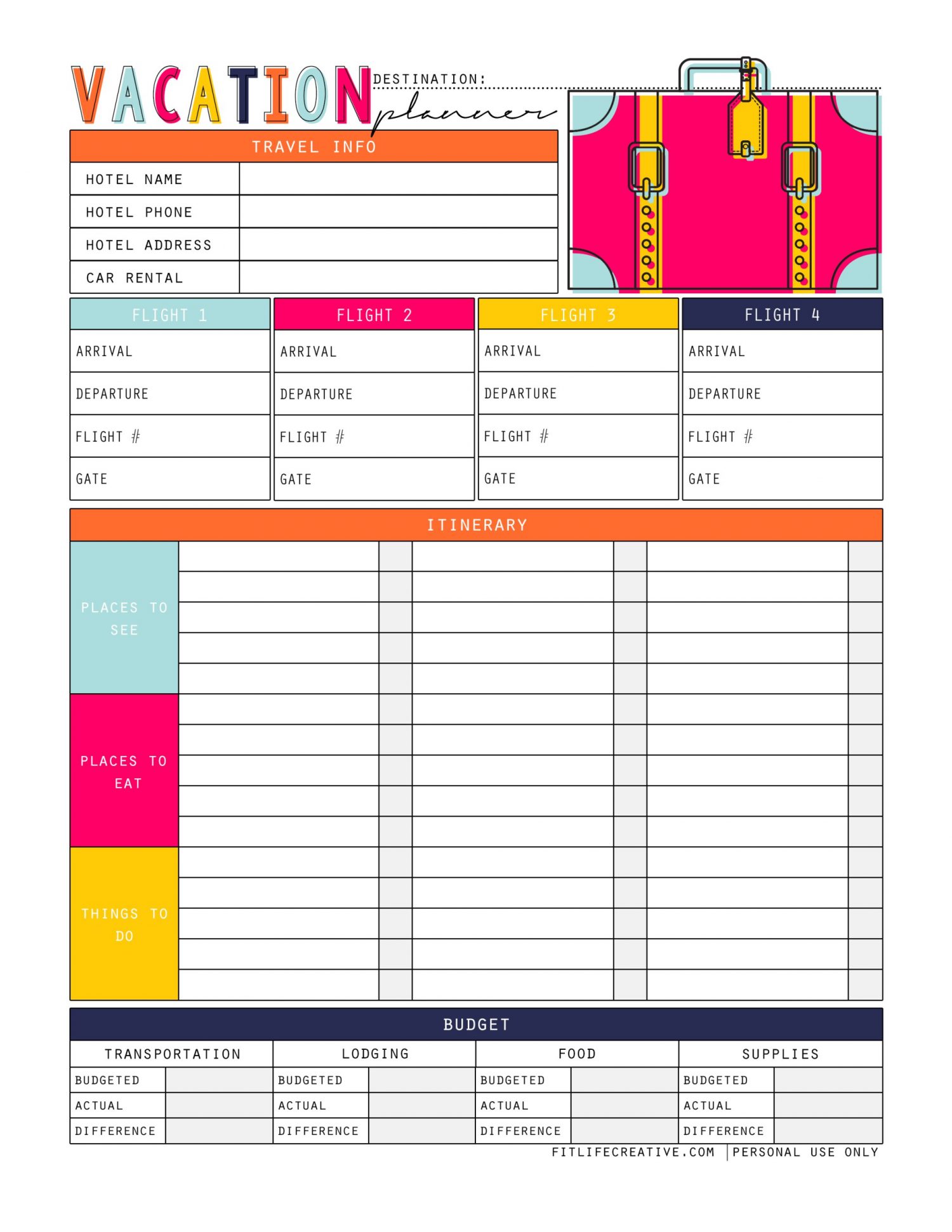

Travel Itinerary Template Family Travel Planner Printable

Team Wiking Printable Travel Planner httpwww

Vacation Travel Planner Printable PDF Sheets My Trip To

Travel Itinerary Template Office

How To Use a Travel Planner Free Printable STOCKPILING

Printable Route Planner planner template free

7 Business Vacation Itinerary Planner SampleTemplatess

Printable Travel Planner Vacation Planner Kit Trip Planner

Free Printable Do List Work Travel Itinerary Template

Travel Itinerary Travel itinerary template Itinerary

Travel Holiday Trip Planner Itinerary planner

Vacation itenerary template Trip Itinerary Template

Vacation Planner Free Printable Guide for Vacation Planning

Travel Itinerary Planner Editable Spreadsheet Etsy

Travel Binder Travel Daily Planner Sarah Titus

Travel Planner

15 ways to get a travel itinerary for visa application

Belum ada Komentar untuk "Travel Itinerary Planner"

Posting Komentar