Vacation Planner

Looking for a Vacation Planner for your Holidays? Discover amazing places, cheap hotels, and reliable homestays for vacations with families, groups, or individuals. Plan your holiday with this vacation planning website. Inspirock is the new way to plan your holiday. Use our free trip planner to get a personalized day by day itinerary for your vacation. Inspiration to see the planet Follow these 4 simple steps to plan a trip & let us know your experience. 1) Choose Your Destination & Dates when you want to travel. Visual algorithmic trip planner lets you choose destinations you want to travel to. You have the freedom to choose the real dates from the calendar. After selecting travel dates, planner runs algorithms to optimize a trip. It starts suggesting activities, sightseeing spots, tours and transport options with the details. For every attraction, it suggests open Plan your trip with Google. Find flights, hotels, vacation rentals, things to do, and more. Template type 1 – plan holidays for up to 7 employees On the first two worksheets you will find 6 months each with the individual weekdays and space for 7 employees. You can print out the sheets and mark which employee is on vacation on which days with color or characters (for example, a cross or dash). Plan vacation all arranged but no idea what’s on the cards when you get there? Let us give you a helping hand. There’s an inspiring display of archaeological insights available at Sobrarbe Geopark Space. It’s an educational and fun exercise for the entire family! Travelers have an abundance of choice in the area. You don’t have to know your Monets from your Picassos to visit Museum of .

A web travel binder of sorts, Planapple helps you collect your ideas, possibilities, and plans — and saves them all in one place, organized and manageable. Bookmark or email your favorites right into Planapple — capturing the details that you’ll otherwise forget to jot down (like hotel addresses and restaurant contact info). Plan your perfect getaway with AARP’s Trip Finder Vacation Planner tool, expert recommendations, travel information and discounts. This can be an Worker Employee Vacation Planner Template Excel you can utilize to package and observe used holiday simply by your worker. Setting up, preparing and keeping track of will be done in Vacation Cost-free Team Holiday Planner Stand out Template to evaluate supply of associates. Determine actual coverage the moment employees wish to get pleasure from ever day of all their vacation and schedule function. The Exceed Employee Vacation pursuing schedule design will be here! Down load Plan your next road trip route with Roadtrippers. Enter where you want to start and finish your road trip, and then discover the coolest “off the beaten path” places along the way. Our database includes millions of the world’s most fascinating places, making planning the unexpected easier than you thought. Road trip route planning can be tedious… and what do you get from it? Most of .

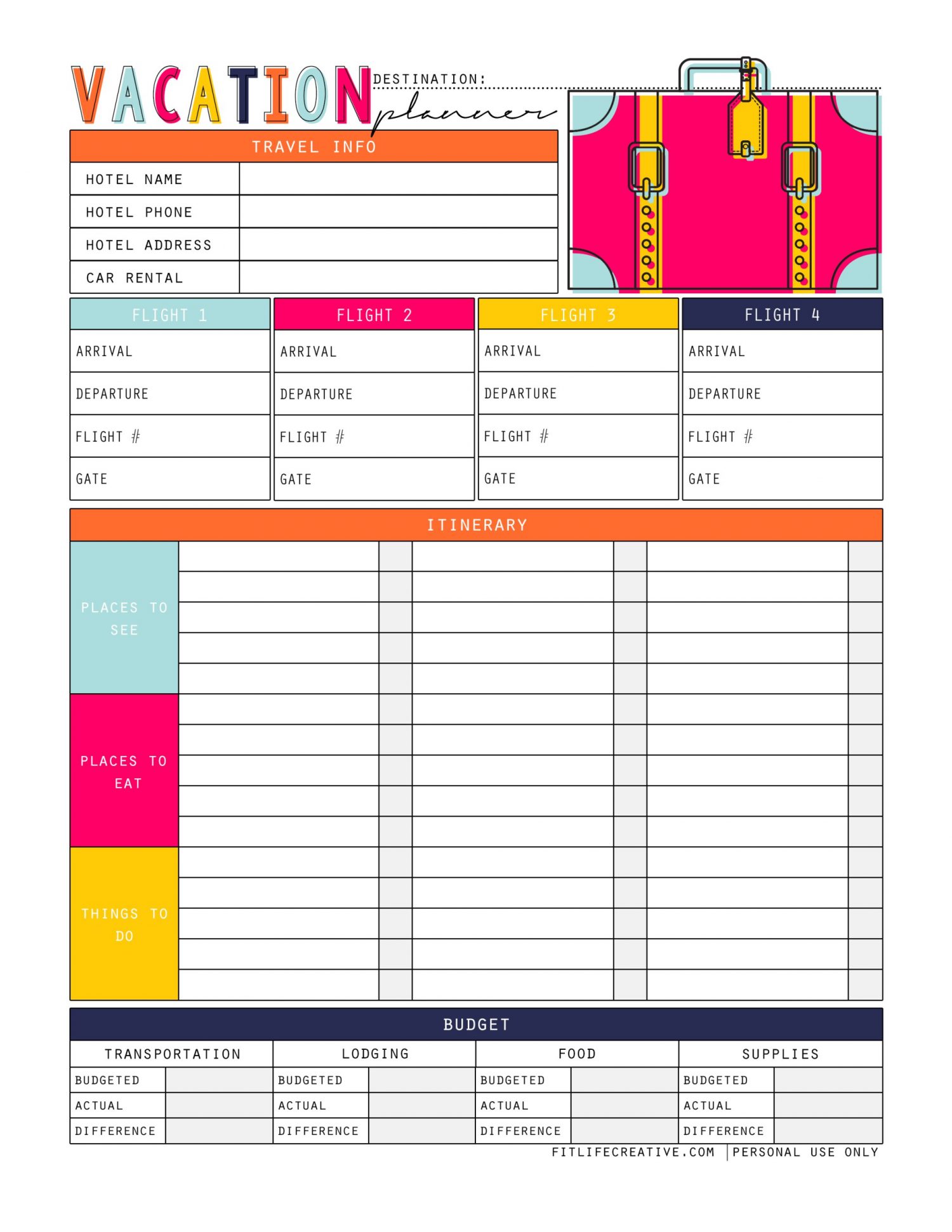

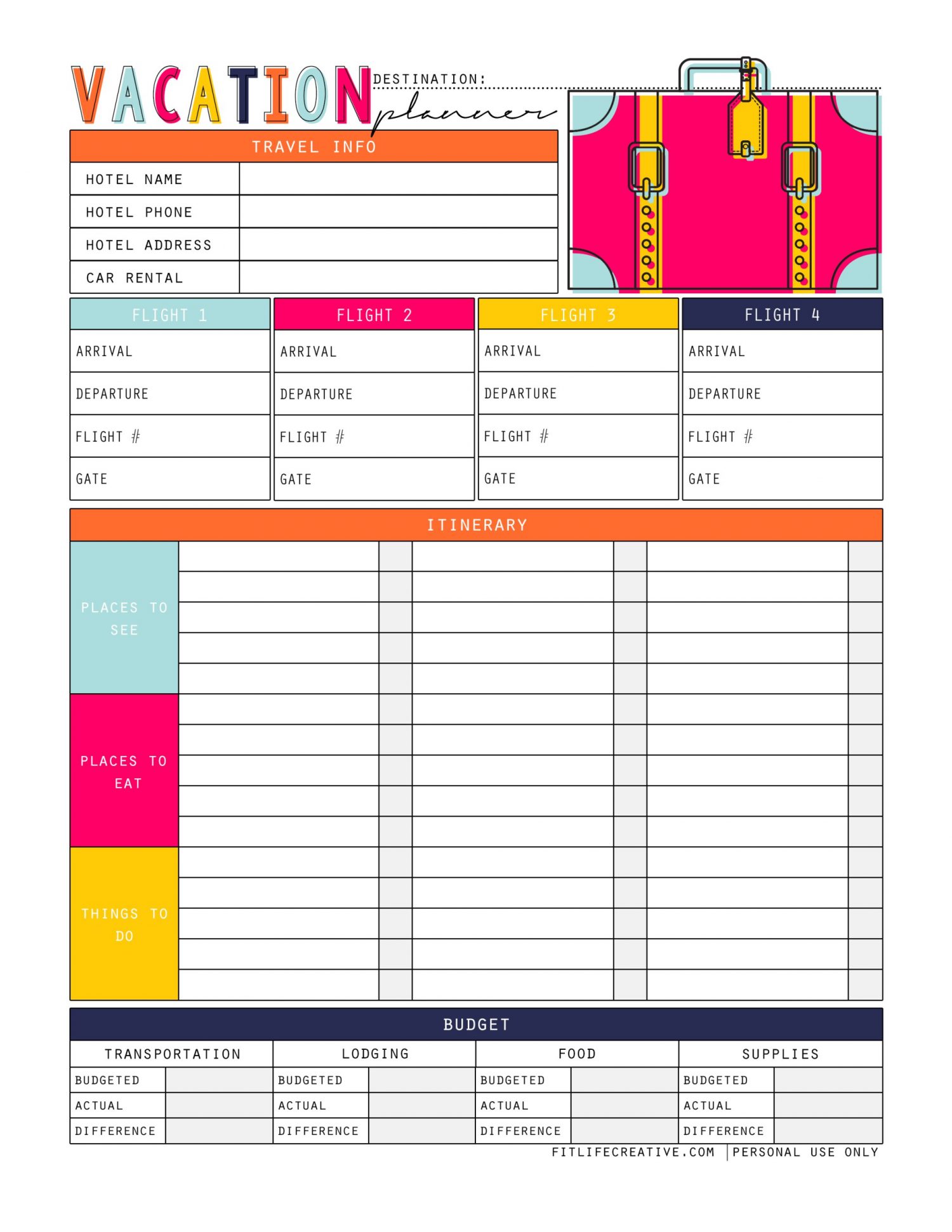

Vacation Planner Free Printable Guide for Vacation Planning

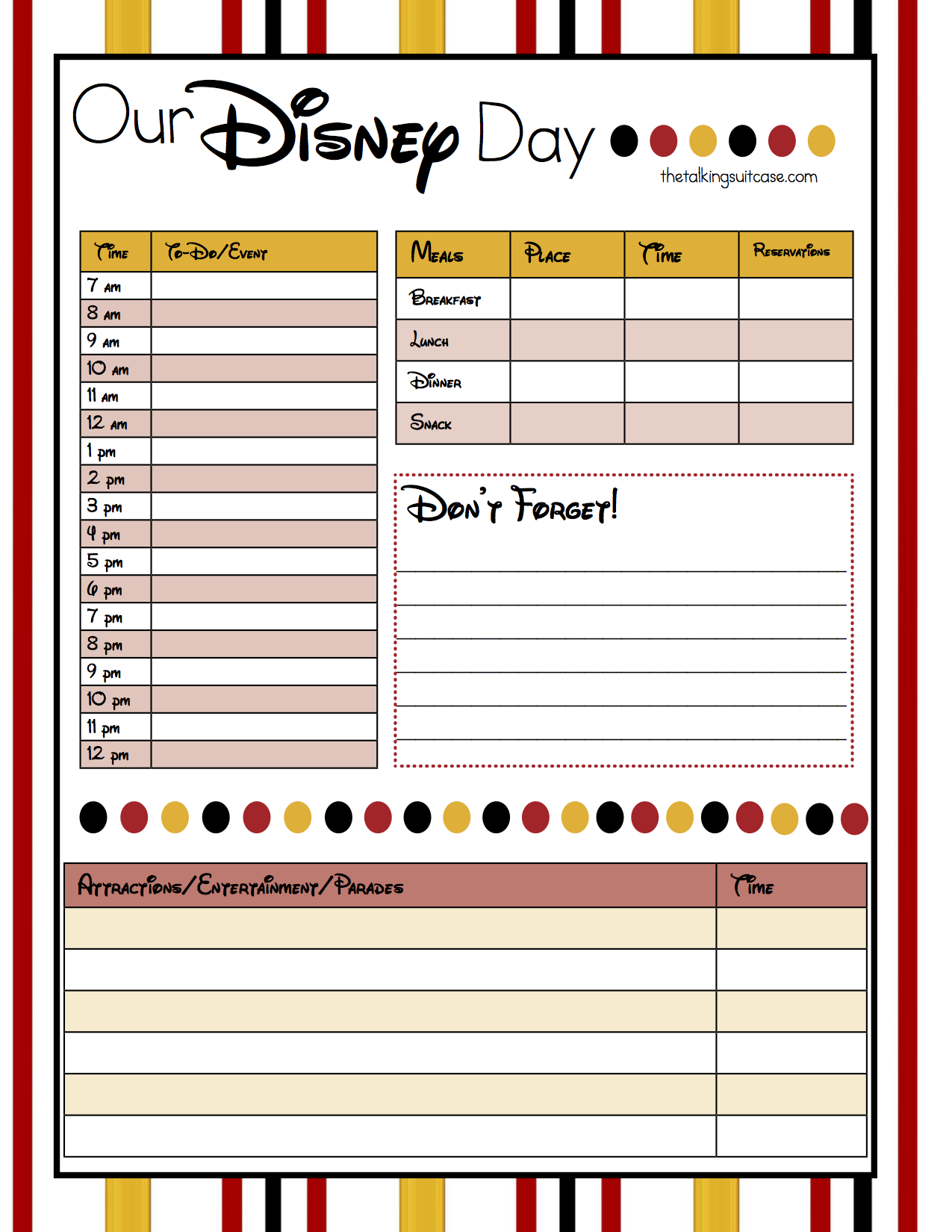

Ultimate Walt Disney World Vacation Planner Dream Plan Fly

The Simply Everything Blog Vacation Planner Printables

Ultimate Walt Disney World Vacation Planner A5 Size

Vacation Travel Planner Printable PDF Sheets My Trip To Etsy

Ultimate Walt Disney World Vacation Planner Dream Plan Fly

VacationPlanner 2018 Excel Templates for every purpose

Vacation Planning Printable Pack Organizing Homelife

Get Ready For Your Disney Vacation Free Printable Disney

How To Use a Travel Planner Free Printable STOCKPILING

Free Printable Vacation Travel Budget Worksheet Travel

Travel Binder Travel Daily Planner Sarah Titus

Ultimate Walt Disney World Vacation Planner Dream Plan Fly

Vacation Trip Planning Checklist to help you stay

Printables Romantic Vacation Planner Mom it ForwardMom

Vacation Planner Binder Mint Notion Shop

Vacation Planner PRINTABLE Holiday Planner by IndigoPrintables

Free Printable Do List Work Travel Itinerary Template

Organize In Style Vacation Planning Printables Lamberts

Mormon Mom Planners Monthly PlannerWeekly Planner

4 Free Vacation Planner In Excel SampleTemplatess

Belum ada Komentar untuk "Vacation Planner"

Posting Komentar