Worldagentdirect

WorldAgent Direct – the Delta Vacations travel agent site – gives you access to a world of vacation options, including one-stop booking for Delta Vacations, in partnership with Delta Air Lines ®, Air France, KLM, Alitalia, Aeromexico and Virgin Atlantic. WorldAgent Direct provides tools and resources for travel agents to book Delta Vacations for their clients. New User Registration : I am the owner/manager and accept sole responsibility for all bookings created on this website under this Agency ID. By checking “I am the owner/manager”, it is understood that the following is the responsibility of the owner/manager of the travel agency WorldAgent Direct provides tools and resources for travel agents to book Delta Vacations for their clients. Registration Travel-industry-affiliated Agency ID and/or current Delta Vacations customers. You have chosen the following product lines to sell through this website: Delta Vacations; In order for you to be approved to sell Delta Vacations brands, you first need to complete the WorldAgent Direct provides tools and resources for travel agents to book Delta Vacations for their clients. Registration. Thank you for registering to use the WorldAgent Direct website. We have received your agency registration and will email your User ID and temporary password within two business days. Once you receive these security codes, you can begin booking WorldAgent Direct product Worldagentdirect is an affiliate marketing tool designed by David Briscoe. It was first released in the beginning of 2020, and it has been a great tool for affiliates to promote products and services online. You are going to want to check out the benefits of this software, and see how you can benefit from it as well. WorldAgent Direct’s headquarters is located in Minneapolis, Minnesota, USA 55435. WorldAgent Direct has an estimated 111 employees and an estimated annual revenue of 38.1M. .

WorldAgent Direct – the Delta Vacations travel agent site – gives you access to a world of vacation options, including one-stop booking for Delta Vacations, in partnership with Delta Air Lines ® , Air France, KLM, Alitalia, Aeromexico and Virgin Atlantic. WorldAgent Direct provides tools and resources for travel agents to book Delta Vacations for their clients. WorldAgent Direct provides travel agents with an efficient tool that offers real time access to flight availability and fares, promotions, news information, and sales tools. Register today and let us show you how WorldAgent Direct can make booking destinations around the world convenient and easy. World Agent Direct- Nick Goddard, Lincoln, NE. 32 likes · 2 were here. Specializing in package vacations, flights, hotels, and transportation. Let me book your next family vacation, honeymoon, .

New WorldAgent Direct Advanced Class Training on Vimeo

NEW Quick Tip Multiple Activities Comparison on

Quick Tip Multiple Hotel Comparison on WorldAgent Direct

NEW WorldAgent Direct Enhancement Expanded Hotel

New Enhancement to WorldAgent Direct Online Group

Attraction World Agent Login

Important Updates Evolution Travel Cafe Page 3

Announcements Archives Page 9 of 19 Evolution Travel Cafe

Travel Agents Direct Mail Database List of Travel Agencies

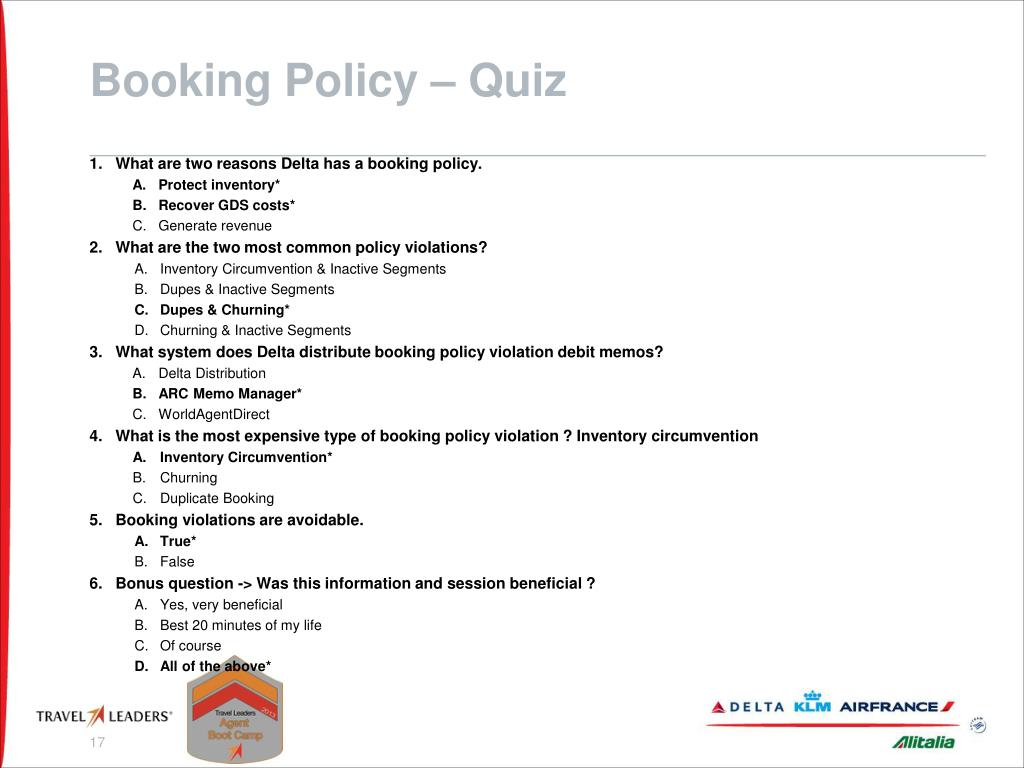

PPT Welcome to Travel Leaders Agent Boot Camp Booking

Delta Europe 2015 by Worth International Media Group Issuu

Say cheers to friends old and new at Breathless Riviera

Compos de 5 cabines le Spa NUXE de lHtel Maakizi en

Dare to soar in the DARE lashes Dares Instagram Style

Belum ada Komentar untuk "Worldagentdirect"

Posting Komentar