Best Trip Planner

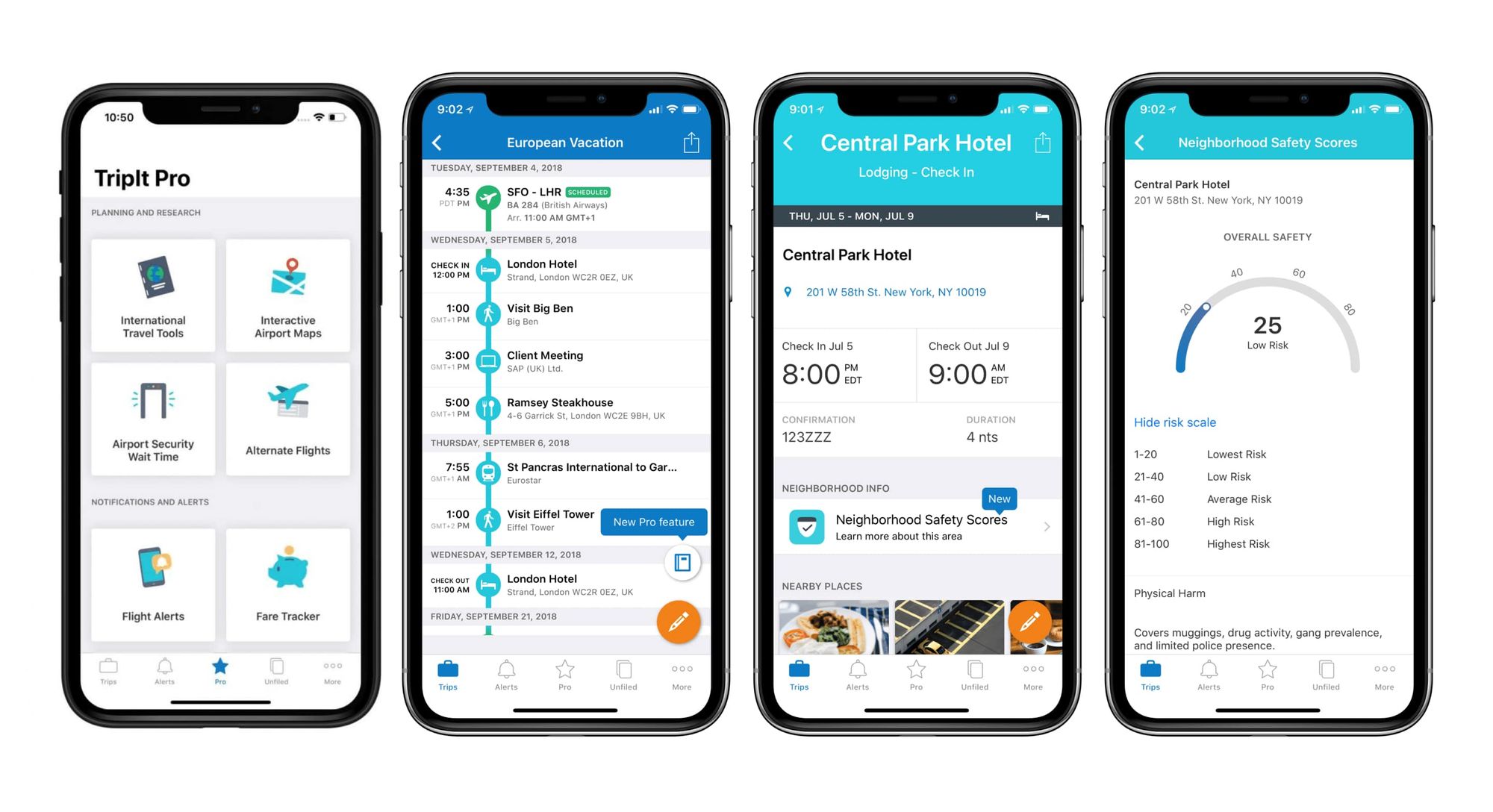

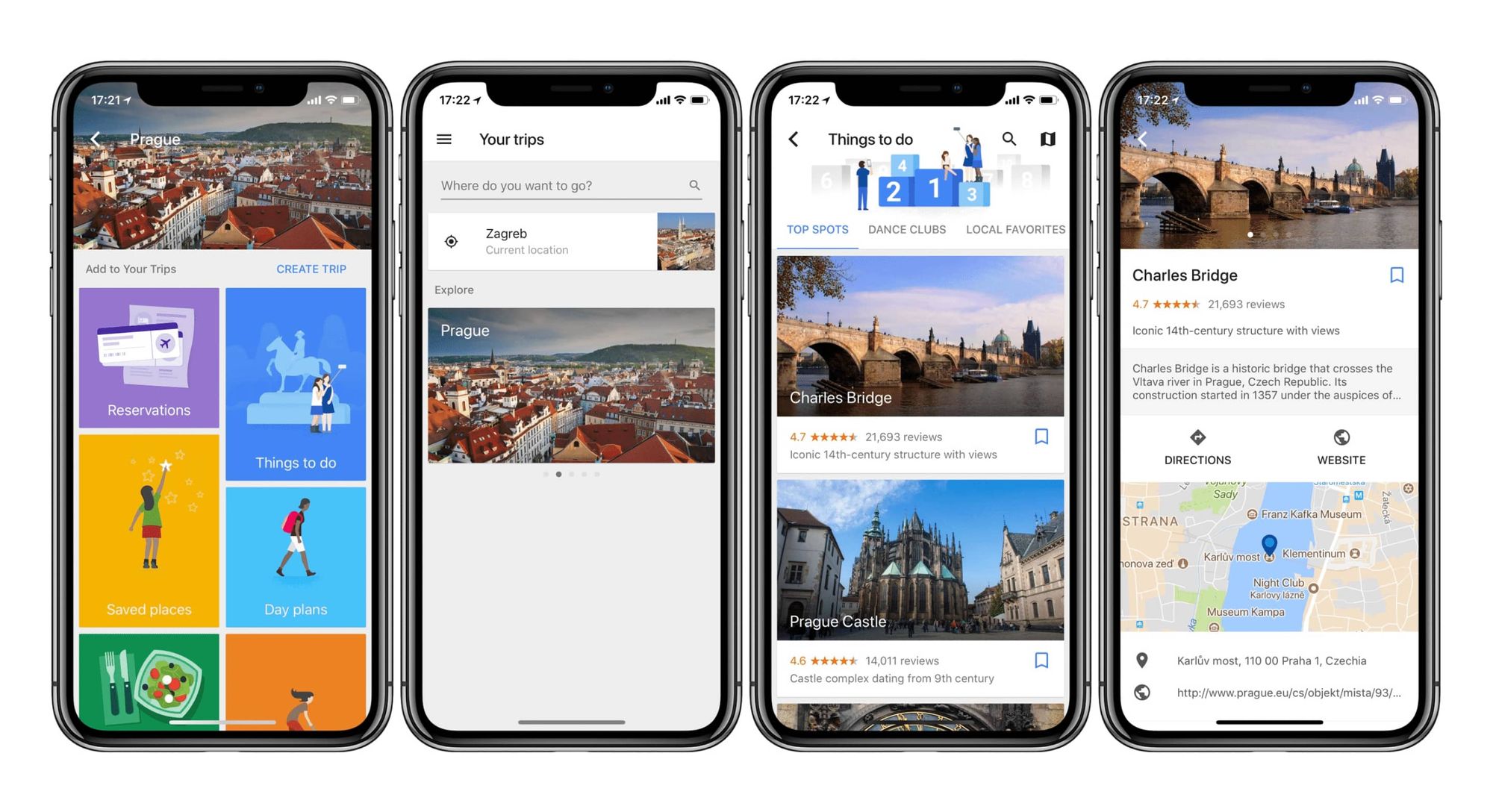

Planning a road trip can be fun, but also stressful. Road trip planner apps can take some of that stress away by helping you plan, organize, and manage it all both before and during your trip. Forget about stashing bulky maps in your glove compartment, trying to decide where to stop, or just winging it. Instead, download these apps to give you peace of mind so you can spend more time enjoying The Best Trip Planner apps can help you answer those questions. I’ve found several that will help you discover the right places to go and organize your day-by-day itinerary in one handy place Roadtrippers is the best trip planning and itinerary app that helps you to create your perfect road trip, discover attractions and useful stops along the way. The Best RV Trip Planner Apps 1. Google Earth / Maps. If you’re scoffing at my first choice and you’re about to click away, bear with me a minute. Google maps certainly have its limitations, however, it can be combined with google earth to create a powerful visualization tool. If you like to see a route before settings off, in particular focusing on areas of interest such as potential low bridges, steep inclines or narrow roads. I guess this is the Best Trip Planner I have ever used. The ability to connect to hotel aggregators, the auto distance calculation, the budget and pricing capabilities, the drag drop features, etc. all have been remarkable so far. The execution is almost perfect. The site is however slow at times probably because of the various elements involved in trip planning process. But if you can Garmin BaseCamp is a free road trip planner for Windows. Using this free software, you can plan your trips easily. You can create a route of your journey on your own and track the created route. On your route, you can also mark more than one waypoints. .

Sygic Travel Trip Planner (Android/iOS, Free) Sygic Travel Trip Planner is focused on the vacationer market, but it’s also great for business users. It offers information on over 20 million places from famous sights and museums, to parks, cafes, restaurants and beaches. In each case, photos, operating hours, and other pertinent pieces of information are included. With Triptile you can plan your trip to Europe just like you want it. Select from over 400 of European destinations, 300 template programs which can be modified just like you want them and from over 3000 activities hand-picked for each destination by expert travel planners to build your perfect European tour program. Triptile gives you control and the freedom to travel to Europe just like you want. Our Europe tour planner is unique and is the most powerful tool out there, which was Roadtrippers will help you find all the best stops along the way. Start Exploring. Hit the road with the app when you’re ready. Sync your trip to your phone, and then let Roadtrippers lead the way with turn-by-turn navigation. Download the App. What our users are saying . This app is beautiful. It isn’t enough that it helps you find amazing places—you can also plan a trip to all of them. I .

The Simply Everything Blog Vacation Planner Printables

:max_bytes(150000):strip_icc()/the-10-best-road-trip-planner-apps-for-2018-4175071-2-5b97e11446e0fb00251b884a.jpg)

8 Best Road Trip Planner Apps for 2019

Best Trip Planner Android Apps TheAndroidPortal

Best Trip Planner Android Apps TheAndroidPortal

:max_bytes(150000):strip_icc()/the-10-best-road-trip-planner-apps-for-2018-4175071-1-5b97d0274cedfd00252663ba.jpg)

8 Best Road Trip Planner Apps for 2019

Best Trip Planner Android Apps TheAndroidPortal

10 Best Road Trip Planner Apps To Help Design Your

:max_bytes(150000):strip_icc()/the-10-best-road-trip-planner-apps-for-2018-4175071-4-5b97f2ab4cedfd0050d2378d.jpg)

8 Best Road Trip Planner Apps for 2019

Best FREE Printable Road Trip planner Download it now

The Best Road Trip Planner Apps Digital Trends

Best Trip Planner Apps for Your Perfect Vacation

The 14 Best Trip Planner Apps for Your Perfect Vacation in

Download Printable Travel Itinerary PDF

:max_bytes(150000):strip_icc()/the-10-best-road-trip-planner-apps-for-2018-4175071-7-5b9817f846e0fb0025bb72a2.jpg)

8 Best Road Trip Planner Apps for 2020

Best Trip Planner Android Apps TheAndroidPortal

Best Trip Planner Apps for Your Perfect Vacation

21 of the BEST Road Trip Planner apps to get before you go

:max_bytes(150000):strip_icc()/the-10-best-road-trip-planner-apps-for-2018-4175071-6-5b98147a46e0fb0025879f35.jpg)

8 Best Road Trip Planner Apps for 2019

Looking for the best trip planner We have best trip and

:max_bytes(150000):strip_icc()/466265589-56a703fd5f9b58b7d0e60e62.jpg)

What You Shouldnt Leave Without When Traveling

10 Best Road Trip Planner Apps To Help Design Your

Belum ada Komentar untuk "Best Trip Planner"

Posting Komentar