Disney Planner

Disney Planner/Beatuty and The Beast planner calendar storybook planner Disney Planner upcycled planner academic calendar daily planner TangledInTradition. From shop TangledInTradition. 5 out of 5 stars (201) 201 reviews $ 34.50 FREE shipping Favorite Add to KOMAR Fenstersticker Disney Planes, 9-tlg. 29,75 € (UVP) 15,99 € Sortierung: Beliebteste Niedrigster Preis Höchster Preis Neueste Artikel Sale Beste Bewertung Feb 24, 2020 – Explore Lisa Zacharias’s board “Disney Planner”, followed by 319 people on Pinterest. See more ideas about Disney, Disney trips, Disney Planner. Disclaimer: The Disney Planner is a fan-based blog based on personal experiences and research, with no affiliation to the Walt Disney Company. Our top-rated Disney travel planner award goes to The Vacationeer. The Vacationeer is known for going above and beyond the limitations of other agencies. They strive to exceed their client’s expectations from the start to the completion of a trip. Disney Planner + Travel Guide – Walt Disney World Vacation Planner – 80 pages of Disney planning info & templates with FREE updates BibbidiBobbidiBi. From shop BibbidiBobbidiBi. 5 out of 5 stars (71) 71 reviews £ 17.40 .

Disney Parks has detailed information on hotels, tickets and packages to help you plan a family vacation to Disney theme parks and resorts. Manage Your Vacation on My Plans — As you book select Resort hotel and dining reservations, park tickets and FastPass+ selections, you can view them all on your My Plans page. My Plans organizes your vacation details into daily itineraries so you can easily update and add reservations or schedule personal reminders. Plus, you’ll get next-steps and key planning dates to help you get the most out of your Walt Disney World vacation. As you book and link your plans to your Disney account, use your My Plans page to manage your vacation details all in one place: Get next-steps and key planning dates. See your hotel and dining reservations, FastPass+ selections and personal reminders organized in a daily itinerary. View your tickets at a glance. Holidays booked through this website are sold by Walt Disney Travel Company (International), a division of The Walt Disney Company Ltd. Registered in London, No. 530051. Registered Office: 3 Queen Caroline Street, Hammersmith, London W6 9PE, UK. Members of ABTA (numbers W1803/P6684) and ATOL (number 10401). .

Ultimate Walt Disney World Vacation Planner A5 Size

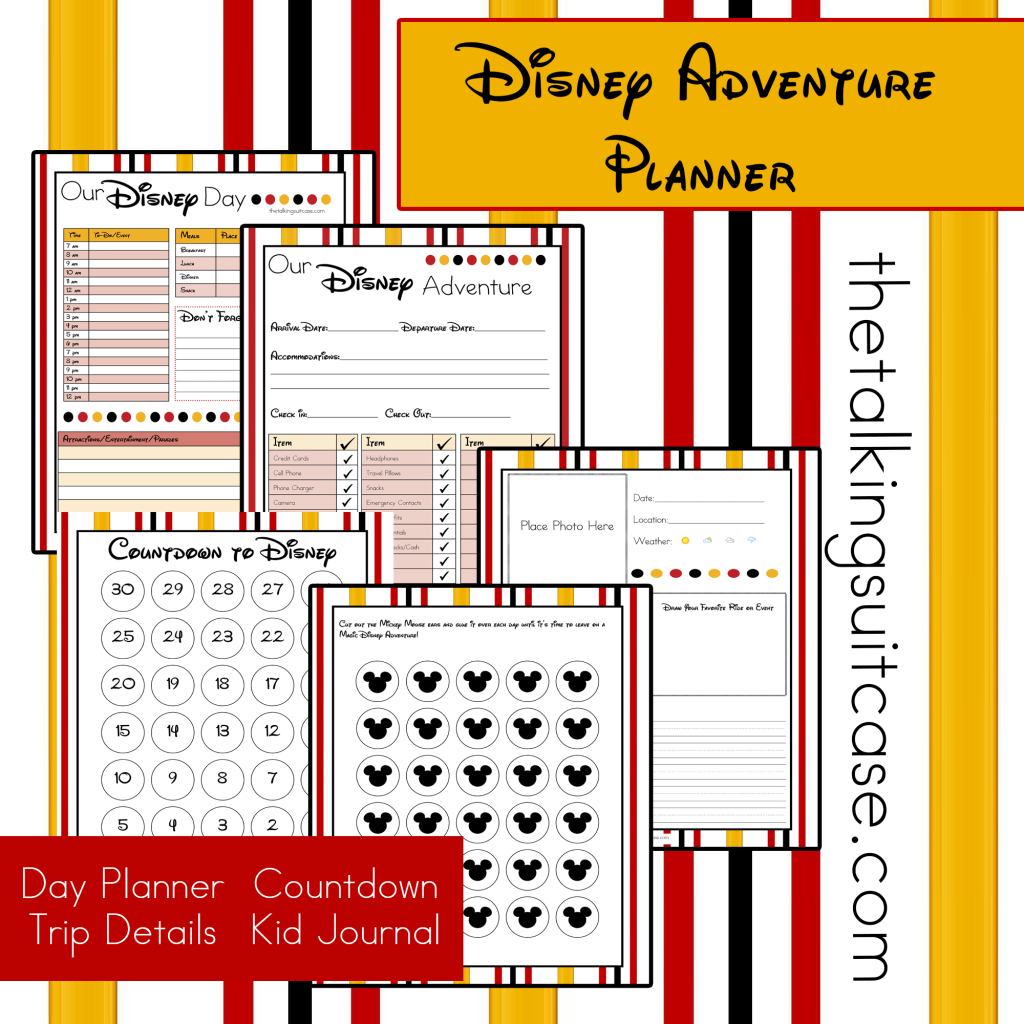

Free Printable Disney Vacation Planner Disney vacations

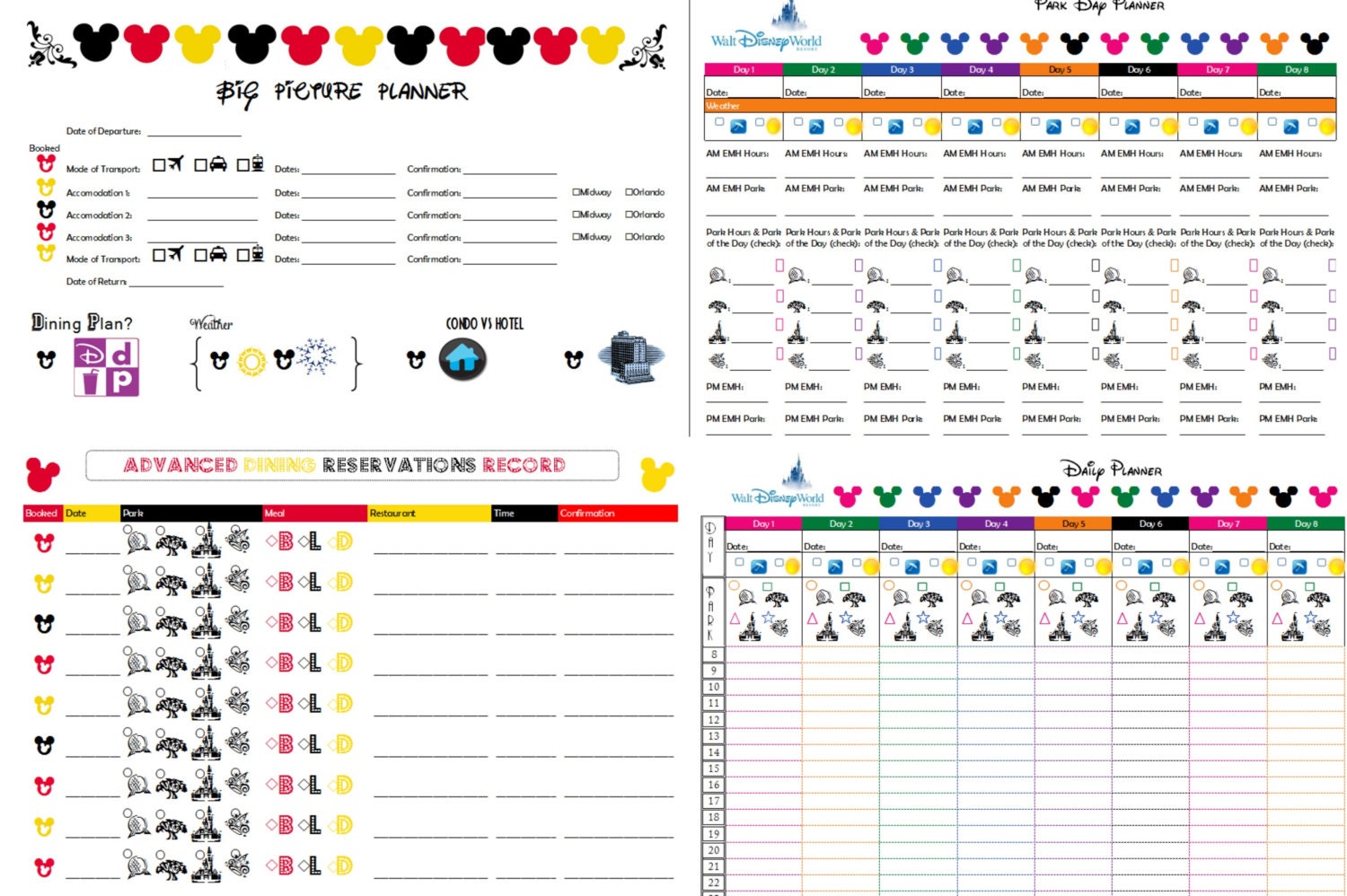

Ultimate Walt Disney World Vacation Planner Dream Plan Fly

Free Disney World Planner Printables Edutaining Adventures

Ultimate Walt Disney World Vacation Planner Dream Plan Fly

Orlando Walt Disney World Vacation Planner Free

Get Ready For Your Disney Vacation Free Printable Disney

Disney World FREE Planning Printables Disney World

Walt Disney World Budget Planner How much will this cost

Instant Download Printable Disney Planner Agenda Itinerary

Are you planning a trip to Disney soon If so come

Walt Disney World Dining Planner Dream Plan Fly

Disney World Planner Template Download Laobingkaisuo Qualads

Ultimate Walt Disney World Vacation Planner Dream Plan Fly

Disney World Trip Planner Binder Starter Set for 9 Day Trip

Disney World Trip Planner Binder Printable

Ultimate Walt Disney World Vacation Planner Dream Plan Fly

Disney World Vacation Planner Binder Set for 9 Day by

DisneyLand Trip Planner Binder Starter Set for 9 Day

2016 Planning Tools for Walt Disney World

Summer Vacation Destinations with a Focus on Families

Belum ada Komentar untuk "Disney Planner"

Posting Komentar