Grotto Bay Beach Resort All Inclusive

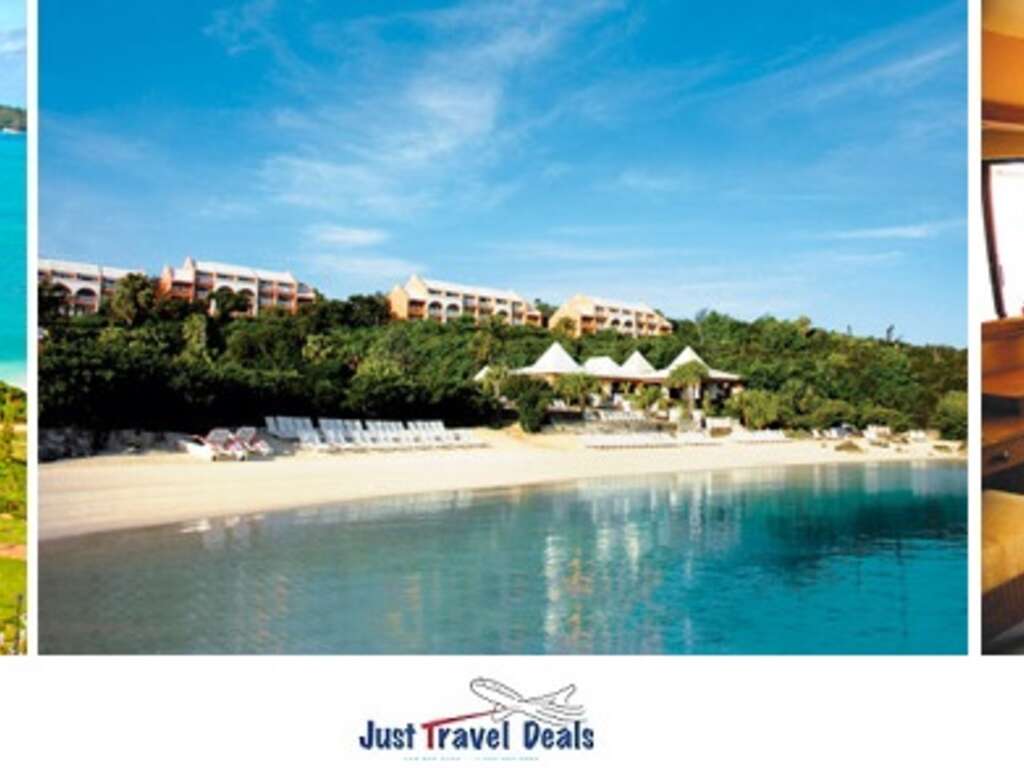

Settled among acres of woodland preserve and overlooking the azure ocean, Grotto Bay Beach Resort & Spa, is where you will find the only true all-inclusive experience in Bermuda. Our exclusive resort is designed to ensure you’ll feel like you are the only guests here with first-class service and Bermudian-style architecture cottages harmonized with nature. Hotel Grotto Bay Beach Resort & Spa, Hamilton Parish: 3.307 Bewertungen, 3.080 authentische Reisefotos und günstige Angebote für Hotel Grotto Bay Beach Resort & Spa. Bei Tripadvisor auf Platz 2 von 2 Hotels in Hamilton Parish mit 4/5 von Reisenden bewertet. Full service resort nestled amid 21 acres along the water’s edge featuring three restaurants, two bars, water sports, dive shop, tennis facilities, cycle livery, three beaches, children’s playground as well as our unique Natura Spa located in one of our Grottos. Grotto Bay Beach Resort All Inclusive offers guests a diverse culinary experience. Two fine-dining establishments, The Hibiscus Room and The Palm Court, provide casual and formal dining options featuring European cuisine and island-inspired dishes. The Bayside Grill serves lunch and your favorite tropical drinks during the summer. Only want to grab a drink and mingle? Check out the Rum House Bar for premium liquors, beers, frozen drinks, wine, and local cocktails. Grotto Bay Beach Resort also features a 100-yard pink-sand beach that runs along the ocean, supplying sunbathing on lounge chairs and swimming in a calm bay. The large freeform pool lies just above the beach and has two sand sunning terraces. Secluded nearby in a garden, a spa tub offers soaking for eight, the perfect way to relax after a fun day on the beach. Full service resort nestled amid 21 acres along the water’s edge featuring three restaurants, two bars, water sports, dive shop, tennis facilities, cycle livery, three beaches, children’s playground as well as our unique Natura Spa located in one of our Grottos. .

GROTTO BAY BEACH RESORT OVERVIEW Grotto Bay is the best value resort on the Island of Bermuda, it is a top 4-star property with an excellent reputation. Located on the east coast, it is just 5 minute’s transfer time to the International airport, across the bridge, which traverses the Estuary in front of the hotel. .

Grotto Bay Beach Resort Bermuda Review Best all

Grotto Bay Beach Resort Bermuda Spas of America Spas of

:max_bytes(150000):strip_icc()/grottobay-5c34fafc46e0fb000132751b.jpg)

AllInclusive Bermuda Destination Wedding Packages

Grotto Bay Beach Resort Bermuda Review Best all

All Inclusive Bermuda Bermuda All Inclusive Resorts

Grotto Bay Beach Resort Bermuda Review Best all

Grotto Bay Beach Resort Bermuda Review Best all

wwwfineandcountrycomuk Take Fine Country

Grotto Bay Beach Resort Spa Review What To REALLY

Top Bermuda Allinclusive Resorts Travel Leisure

Grotto Bay Beach Resort Rest of the World Saga

The Grotto Bay Beach Resort spa is stunning Grotto bay

Grotto Bay Beach Resort Bermuda Review Best all

Grotto Bay Beach Resort Bermuda Review Best all

Buffet at Grotto Bay Beach Resort The only allinclusive

Spend Your Next Birthday Getting Pampered in a Cave

Grotto Bay Beach Resort Travel Leisure

Grotto Bay Beach Resort A Kuoni Hotel in Bermuda

Grotto Bay Beach Resort Bermuda

:max_bytes(150000):strip_icc()/ScreenShot2019-11-07at1.04.43PM-c606f390d456476ea65f981bc28aefed.png)

AllInclusive Bermuda Destination Wedding Packages

Grotto Bay Beach Resort Hamilton Resorts Reviews Book

Belum ada Komentar untuk "Grotto Bay Beach Resort All Inclusive"

Posting Komentar