Pebble Beach Resorts

Join us at Pebble Beach Resorts and make your own unforgettable memories. Today at Pebble Beach. September 19, 2020. 10:00 AM – Trail Rides at Pebble Beach Equestrian Center; 5:45 PM – The Spanish Bay Bagpiper; View All Events. Inside Pebble Beach. The Beautiful Beaches of Pebble Beach. The Beautiful Beaches of Pebble Beach Posted in Experiences on July 15, 2020 | 4 min read Read More For more than a century, Pebble Beach Resorts has been a special seaside escape for golf and grand accommodations on California’s majestic Monterey Peninsula. Experience peaceful relaxation and memorable service at each of our three unique resorts — The Lodge at Pebble Beach, The Inn at Spanish Bay and Casa Palmero. Resort Reservations. Plan My Trip. The Lodge at Pebble Beach. The Lodge is The #1 Best Value of 10 places to stay in Pebble Beach. Free Wifi. Free parking. The Inn at Spanish Bay. Show Prices. #2 Best Value of 10 places to stay in Pebble Beach. Free Wifi. Free parking. The Lodge at Pebble Beach. Show Prices. 1,517 reviews. #3 Best Value of 10 places to stay in Pebble Beach. Die besten Preferred Hotels & Resorts in Pebble Beach: Finden Sie 1.462 Reisebewertungen, authentische Fotos und Preise für 3 Preferred Hotels & Resorts in Pebble Beach, Kalifornien. Take advantage of our packages and special offers to experience all that Pebble Beach Resorts has to offer. As a resort guest, you’ll also receive special booking privileges for golf reservations. FALL STAY & PLAY PACKAGE Two Nights, Two Rounds, Resort Credit & more! Your Pebble Beach Vacation Awaits . Call Resort Reservations. Reservation Requests. Plan My Trip. Fairway One at The Lodge A Address of Pebble Beach Resorts, submit your review or ask any question, search nearby places on map. WorldPlaces 🇺🇸 Please click here to show the map. Pebble Beach Resorts. Address 1700 17-Mile Drive, Pebble Beach, Californie, États-Unis 93953 . Phone (866) 876-3130 . Website(s) www.pebblebeach.com . Categories Golf Course & Country Club, Hotel Resort, Travel Company . Facebook rating .

The Lodge at Pebble Beach Resort combines stately architecture with attentive hospitality & relaxed elegance. Plan a stay at one of Monterey top 5-star hotels. Pebble Beach is the No. 1 Golf Resort in America. With three Top 50 public courses canvasing the spectacular coastline that wraps around California’s Monterey Peninsula, golf at Pebble Beach Resorts is a truly unforgettable experience. Whether you are skirting the scenic sand dunes at Spanish Bay, threading the towering pines of Spyglass Hill, or challenging the cliff-swept shoreline at Pebble Beach, Marriott hotels, the Golden Gate Bridge District, as well as Bay Area restaurants and wineries have decided to launch major job cuts, with one employer warning that even more layoffs … .

Pebble Beach Resorts Golf Resorts Courses Spa Vacations

Yet Another Reason To Visit Pebble Beach Resorts This Season

Pebble Beach Resorts

Pebble Beach Resorts Golf Resorts Courses Spa Vacations

Legendary Golf Courses at Pebble Beach Resorts California

Pebble Beach Resorts A beginners guide Golf Advisor

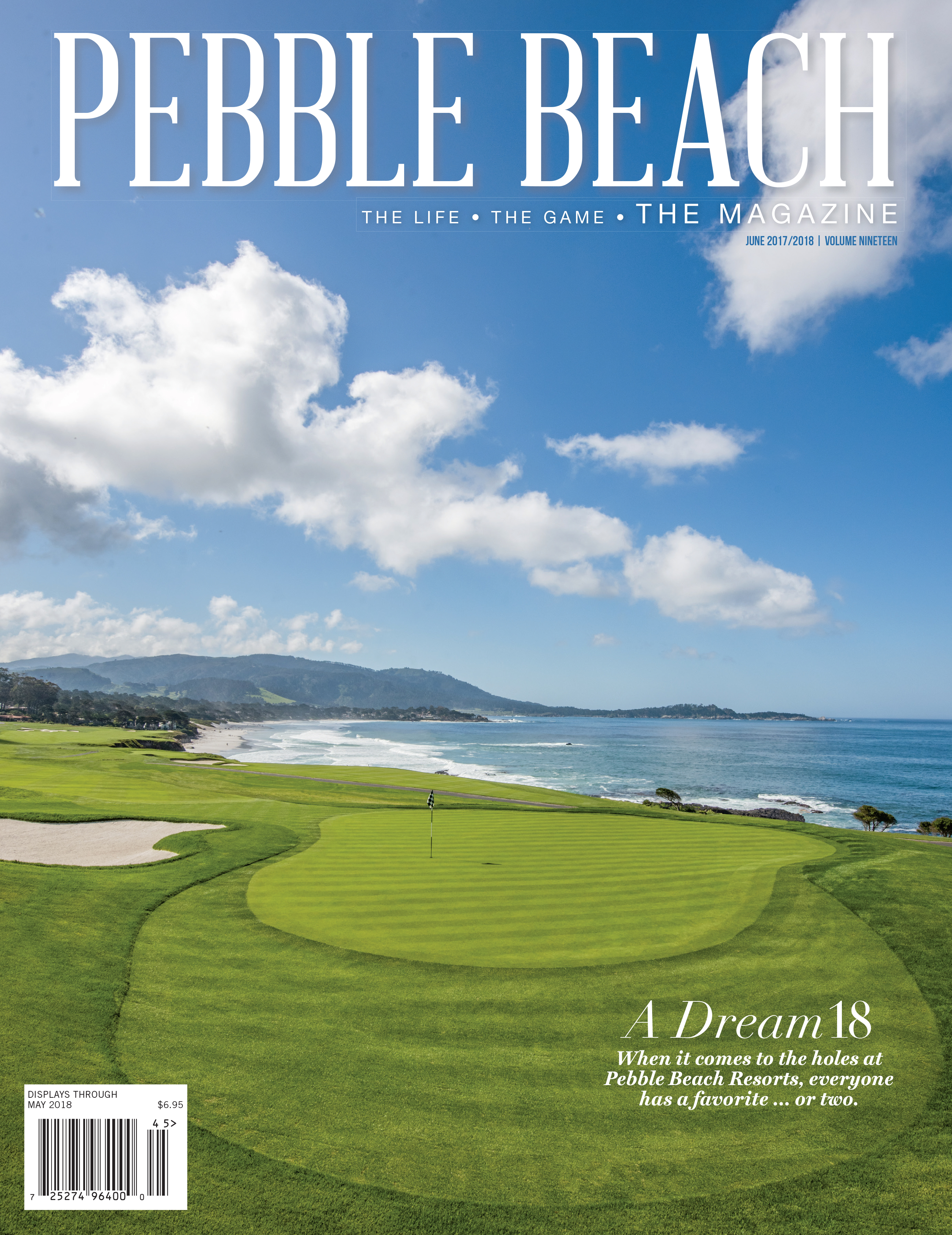

The Pebble Beach Resorts Dream 18 The Front Nine

Guest Post My 10 Favorite Photos Ive Taken Around Pebble

Pebble Beach Resorts Golf Vacation Packages

Pebble Beach Resorts Exclusive Resort Amenities

Play 7 of the Worlds Greatest Golf Holes at Pebble Beach

XOJET Blog Official Private Aviation Partner of Pebble

The Pebble Beach Resorts Dream 18 The Back Nine

Guest Post My 10 Favorite Photos Ive Taken Around Pebble

Pebble Beach Resorts Golf Resorts Courses Spa Vacations

World Invitational Father Son Golf Tournament at Pebble

Play 7 of the Worlds Greatest Golf Holes at Pebble Beach

The Pebble Beach Resorts Dream 18 The Front Nine

National Golf Month Getaways Luxe Beat Magazine

Pebble Beach Resorts john risser

Pebble Beach Resorts Carr Golf

Belum ada Komentar untuk "Pebble Beach Resorts"

Posting Komentar