Planning A Trip To Disney World On A Budget

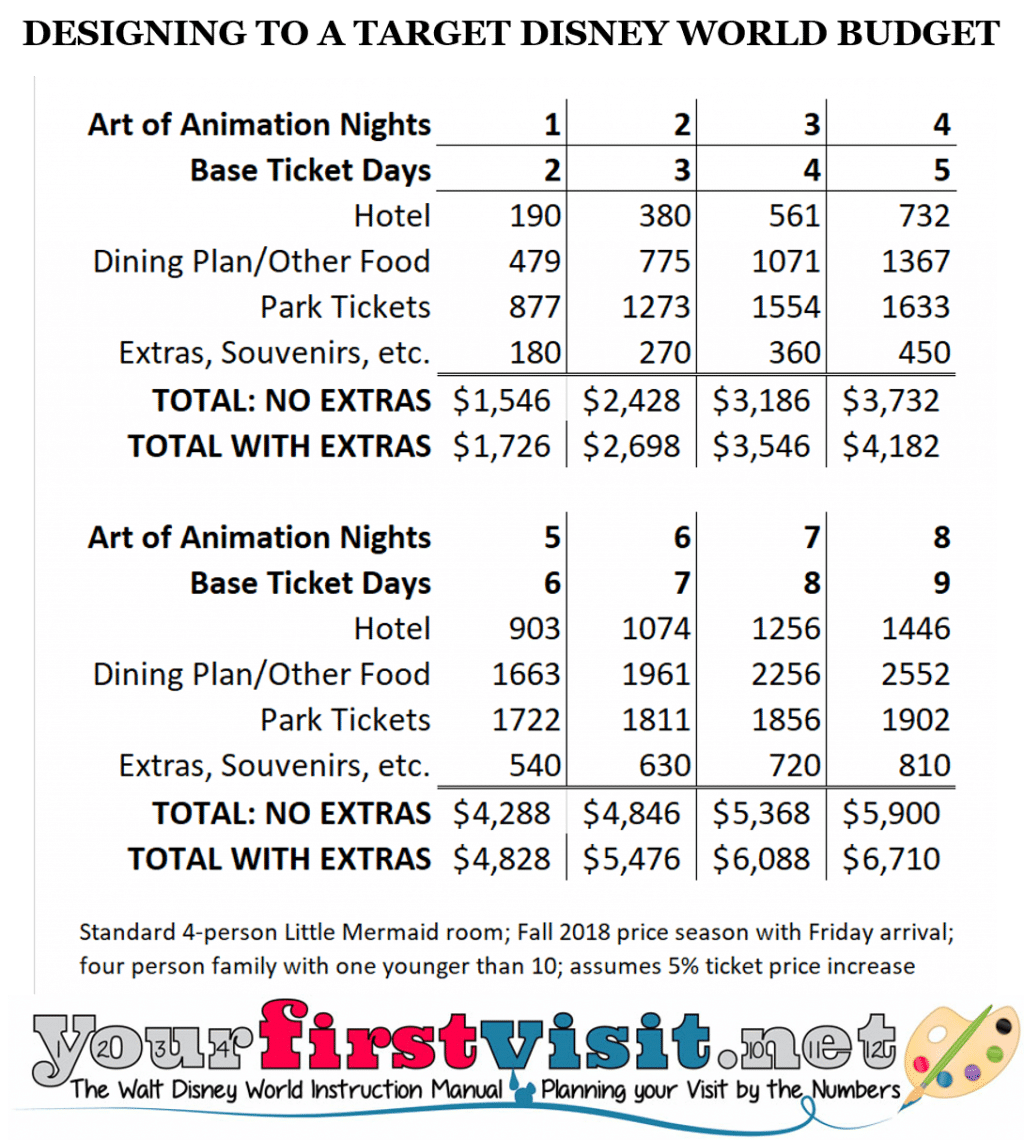

I just love Disney World. And planning Disney vacations is one of my spiritual gifts. For a family of four, a week at Disney could cost anywhere from $4,000–10,000 or more, which is a lot of money! But you can do it for less. There are plenty of ways you can save money on your Disney vacation—up to thousands of dollars, actually. You just have to do some planning up front. 10 Ways to Save Being strategic when planning your trip to Disney World on a budget is of the utmost importance. This is how you will discover more ways to save and what expenses you can eliminate. To begin organizing your vacation, start with these tips: Have Flexible Travel Dates It pays—literally—to plan ahead. Every extra day you spend inside a Disney park cuts dollars off park admission as a whole. Current regular admission rates start at $109 per person (ages 10+) for a single-park day pass, but stay three days and that price per day drops to $105. Stay four days and it drops to $101. Stay five days and it drops to $83….you get the picture. Also, if you already know you’re headed to Disney in the coming year, don’t wait to buy. The parks rack up their Yes, Planning A Trip To Disney World On A Budget is possible! It’s never going to be the cheapest trip, but there are many ways you can save money on accommodation, transport, and food. We’ve been to Disney World in Orlando, Florida three times as adults. The first two times we were on a tight budget and stayed in off-site motels and packed sandwiches. On our latest trip we had more to spend and stayed in Disney World’s cheapest resort hotel and ate in the parks at a mix of fast food Planning a Disney World Trip on a Budget 1. Get Your Paperwork Organized. This may go without saying, but the truth is, to be really successful at planning a Disney World trip, you need to get organized. Without a bit of organization, a trip like this is just stressful. Remember — being disorganized (in any area of life) costs you money in Planning a Walt Disney World trip? On a budget? I hear you! Many families dream of planning a Disney vacation, but sometimes it can feel cost prohibitive. Multi-day theme park tickets for a family of four can quickly cost over $1,000, before transportation, lodging, or food expenses. Is it possible to have a magical Disney World trip on a budget? Yes! .

I just started planning Disney vacations as a travel agent and was able to save someone $400 on their vacation just by switching the weeks. Fill out a quote request. My service is free. I’m always shocked by answers so here are a few: Some of my twitter friends helped too! Obviously, these numbers are super high. Especially when you’re on a budget or are trying to fit multiple high cost When planning a trip to Disney on a budget, there are two main types of accommodations; a Disney hotel or a non-Disney hotel. Cheapest: A hotel not on Disney property. Cheapest for a bigger family: AirBnB. The truth is, Disney World resorts are some of the most expensive resorts almost never going below $137 per night. Planning A Trip To Disney World On A Budget requires some research and just the right technique. Why? Because Disney World is the size of San Francisco, and after over 30 trips, even I haven’t done it all. This isn’t going to be the typical plan a Disney World trip post, or even the usual save money at Disney World post. It’s going to be more of us taking a step back and looking at Budget Travel. Disney World is a truly magical place, making it one of the most popular holiday destinations in the world. However, there is nothing magical about what it costs to plan a trip here. Fortunately, there are many ways to make a Disney visit much more affordable. Here’s the ultimate guide to planning a cheap Disney World vacation! Disney World: An Overview. When you think of Disney .

Walt Disney World Free Printables Our Handcrafted Life

Walt Disney World Vacation Budget Worksheet Disney world

DesigningaDisneyWorldVisittoaTargetBudgetfrom

Walt Disney World Travel Info Planner Dream Plan Fly

Ultimate Walt Disney World Vacation Planner Dream Plan Fly

Designing Your Walt Disney World Vacation to a Lower

Walt Disney World Budget Planner How much will this cost

Free Printable Disney Vacation Planner Disney vacations

Walt Disney World Touring Plan Spreadsheet Dream Plan Fly

Ultimate Walt Disney World Vacation Planner A5 Size

Picturing Disney Plan Your Trip

Are you planning a trip to Disney soon If so come

/disney-world-vs-disney-cruise-3266408-FINAL-5c3df46fc9e77c00013fd0cb.png)

Disney Travel Planning Disney World vs Disney Cruise

Free Printable Disney Vacation Planner Disney planner

Free Disney Itinerary Printable Mom Explores Virginia

Disney World Planner Template Download Laobingkaisuo Qualads

2016 Planning Tools for Walt Disney World Walt disney

Walt Disney World Free Printables Disney world packing

Disney World Planner Updated for the Opening of Toy Story

Disney World Itinerary Template Example Calendar Printable

Walt Disney World Vacation Budget Worksheet Disney world

Belum ada Komentar untuk "Planning A Trip To Disney World On A Budget"

Posting Komentar