Vacation Trip Planner

Use our free trip planner to get a personalized day by day itinerary for your vacation. Inspirock is the new way to plan your holiday. Inspiration to see the planet. Profile. My account; Log out; Log in; Start planning; 1,208 trips planned today. 4.6. out of 5. Trustscore rating. The new way to plan your next trip Create a fully customized day by day itinerary for free. Itinerary planner + Add Since flights are not working and I am already done with road trips weekend trips during this pandemic I started planning for my next vacation to keep myself motivated in this hard time. While browsing on google I found this website and when I started using, I felt that the product is very exciting and engaging! I loved the fact that it breaks the itinerary by day to plan a trip and suggests World’s Smartest Vacation Planner TripHobo – Trips, Tales & Trust Plan Your Next Vacation Find Tours & Activities. Excellent 4.6 /5. Trustpilot. User-Friendly. 18/01/2020. User-Friendly, very useful for planning trips and looking for places to visit. Nat. Great travel planning tool for avid travelers. 18/12/2019 . As an avid traveler, I’ve never been so excited to discover this site. It was Road trip route planning can be tedious… and what do you get from it? Most of what you find online will funnel you into the same places, filled with other travelers. It can feel like you need a local guide to get an authentic experience on your trip, but Roadtrippers helps you escape the tourist bubble and find the coolest stops. Plan Your Trip Now. Discover the most incredible people FREE cancellation on select hotels Bundle Plan flight + hotel & 𝘀𝗮𝘃𝗲 up to 100% off your flight with Expedia. Build your own Plan vacation package & book your Plan trip now. Our vacation inspired me to create your free trip planner printables on the blog today. I felt we needed some organizers to make sure we won’t forget anything important for the trip. A little planning ahead, I thought, would make the travel a delightful one for the family. Hence, just last night, I again tried my hands at creating a trip planner. .

Collect your vacation ideas in an online trip notebook, and keep everything organized in one place.. Travel planning shouldn’t feel exhausting. It should be exhilarating! … But when your inbox gets cluttered with ideas and requests from tripmates, your browser’s bursting with bookmarked hotels and restaurants, and you’ve lost track of your notes from perusing piles of travel mags — it can Map your trip with our free trip planner tool. Great for mapping road trips, planning your itinerary, or getting directions to city in the world. Tripomaticis a great travel-planning app that uses a map to explore locations. They use their own database of tourist attractions, which means that there is a limit to the number of cities (about 1500) and sights you can add to your trip. They have a mobile app, and you can upgrade to premium to view your trip on an offline map. 3. Find the shortest routes between multiple stops and get times and distances for your work or a road trip. Easily enter stops on a map or by uploading a file. Save gas and time on your next trip. .

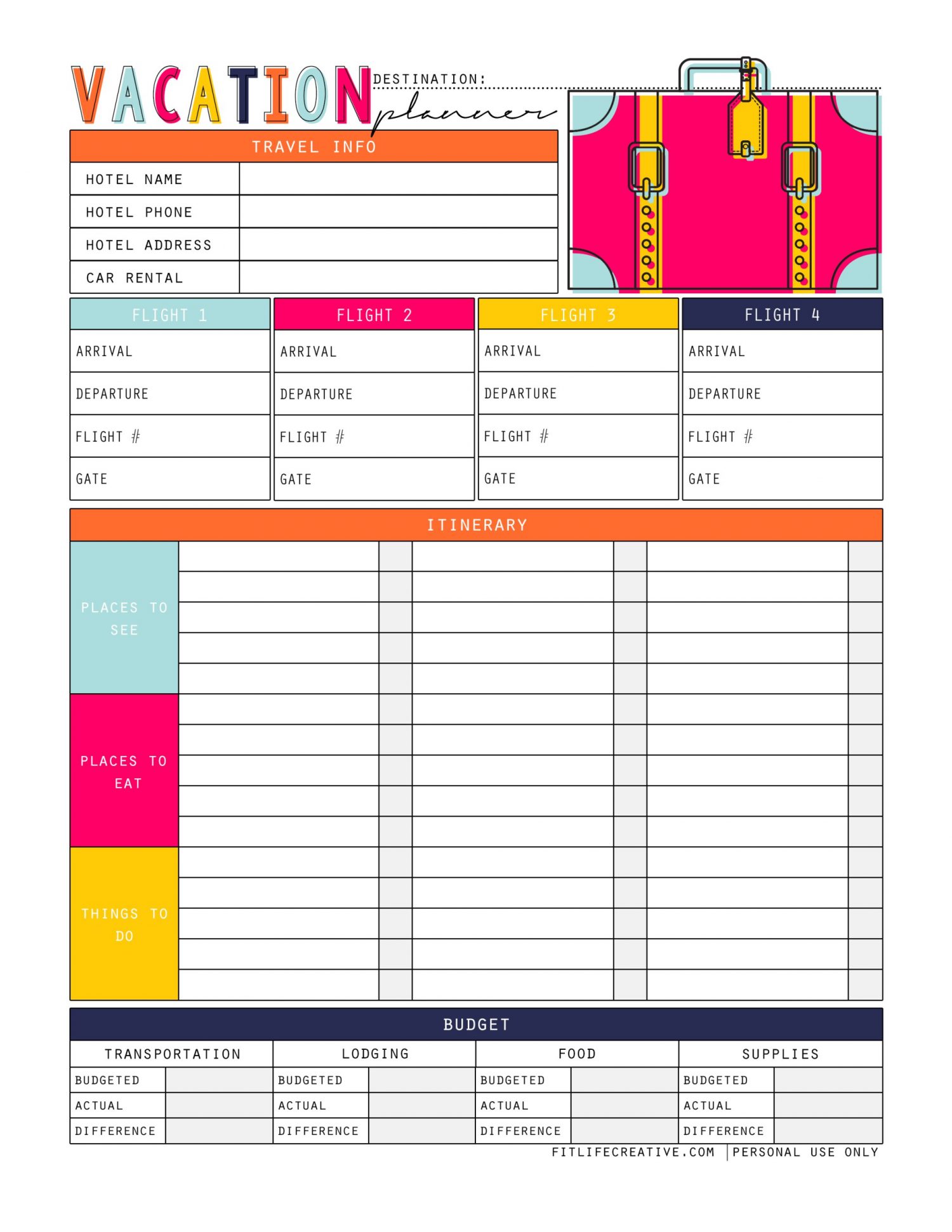

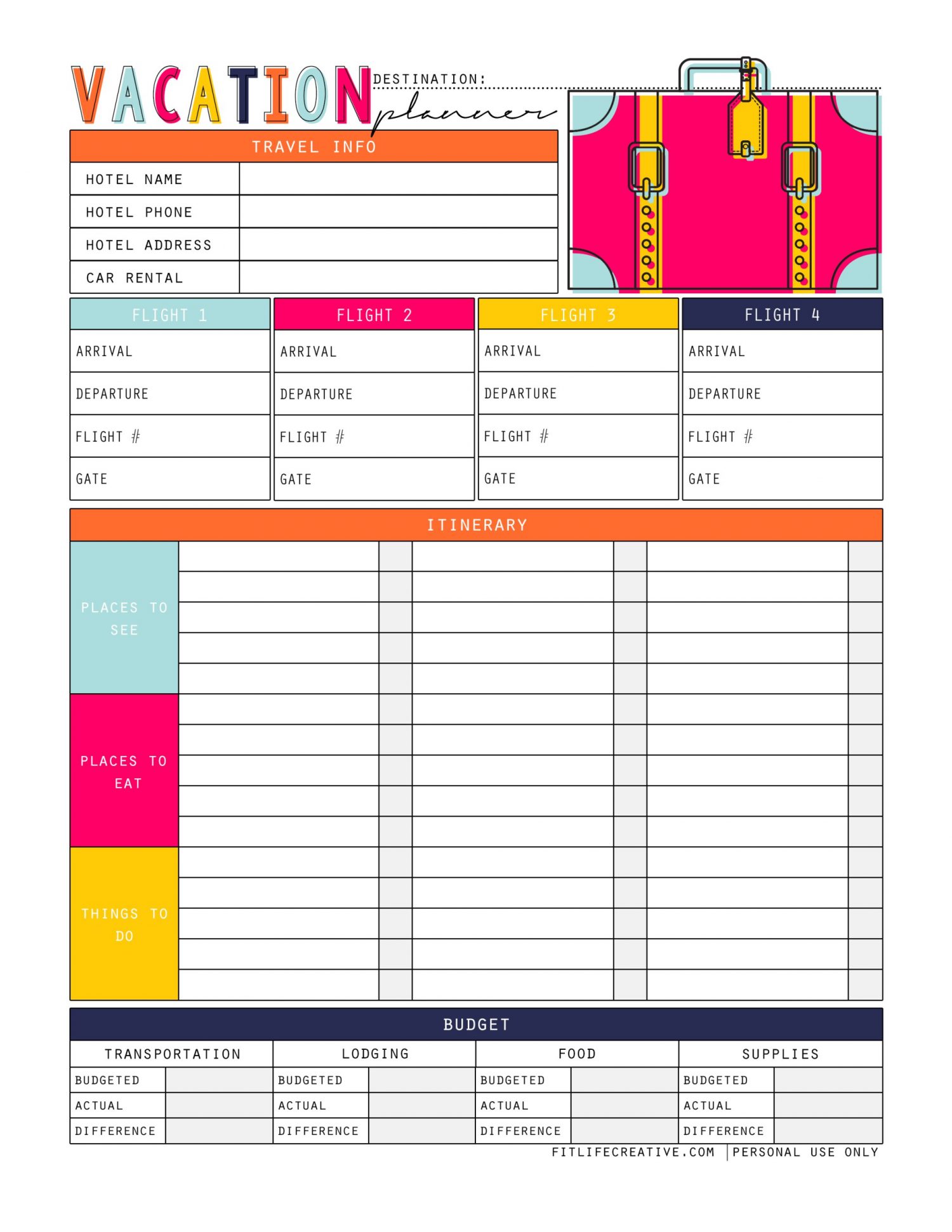

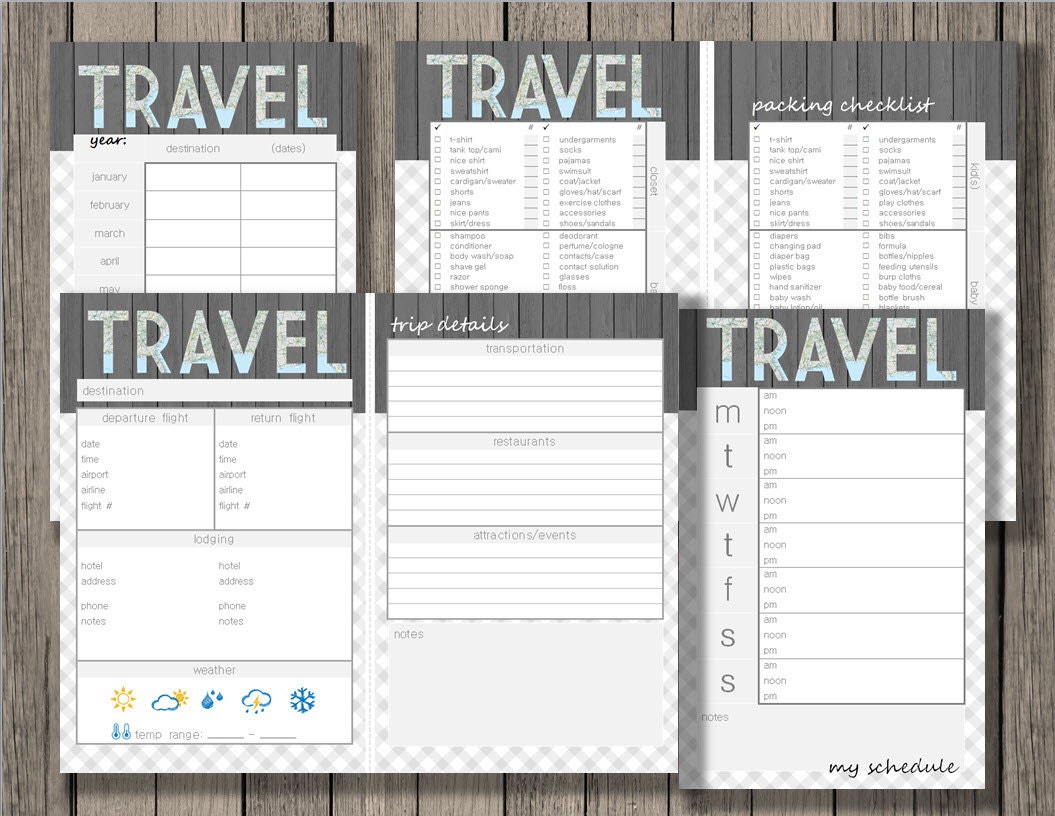

Vacation Planner Free Printable Guide for Vacation Planning

How To Use a Travel Planner Free Printable STOCKPILING

The Simply Everything Blog Vacation Planner Printables

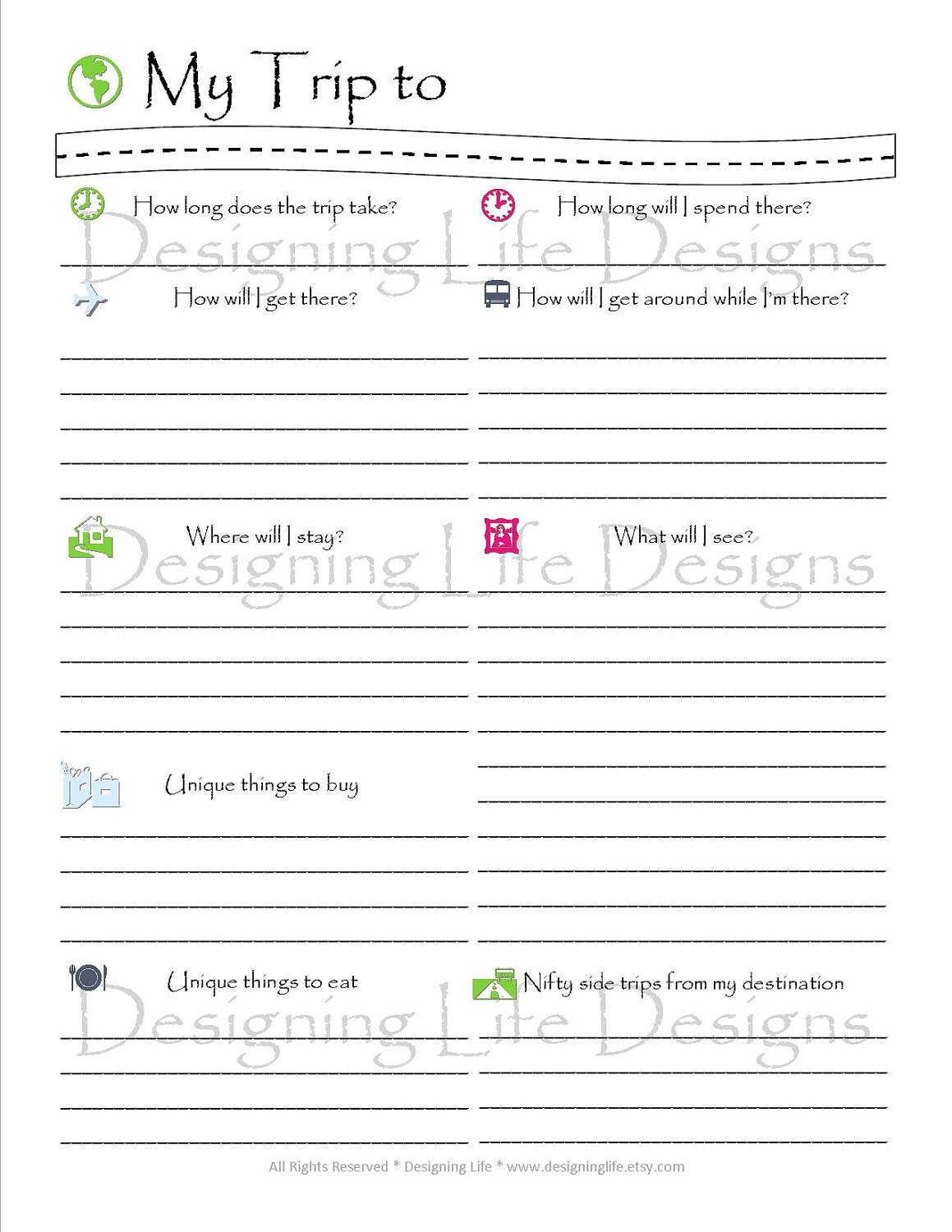

Vacation Travel Planner Printable PDF Sheets My Trip To Etsy

Ultimate Walt Disney World Vacation Planner Dream Plan Fly

Ultimate Walt Disney World Vacation Planner Dream Plan Fly

Travel Binder Travel Daily Planner Sarah Titus

Free Printable Vacation Travel Budget Worksheet Travel

Vacation Travel Planner Printable PDF Sheets My Trip To

Print this free road trip planner to help you create the

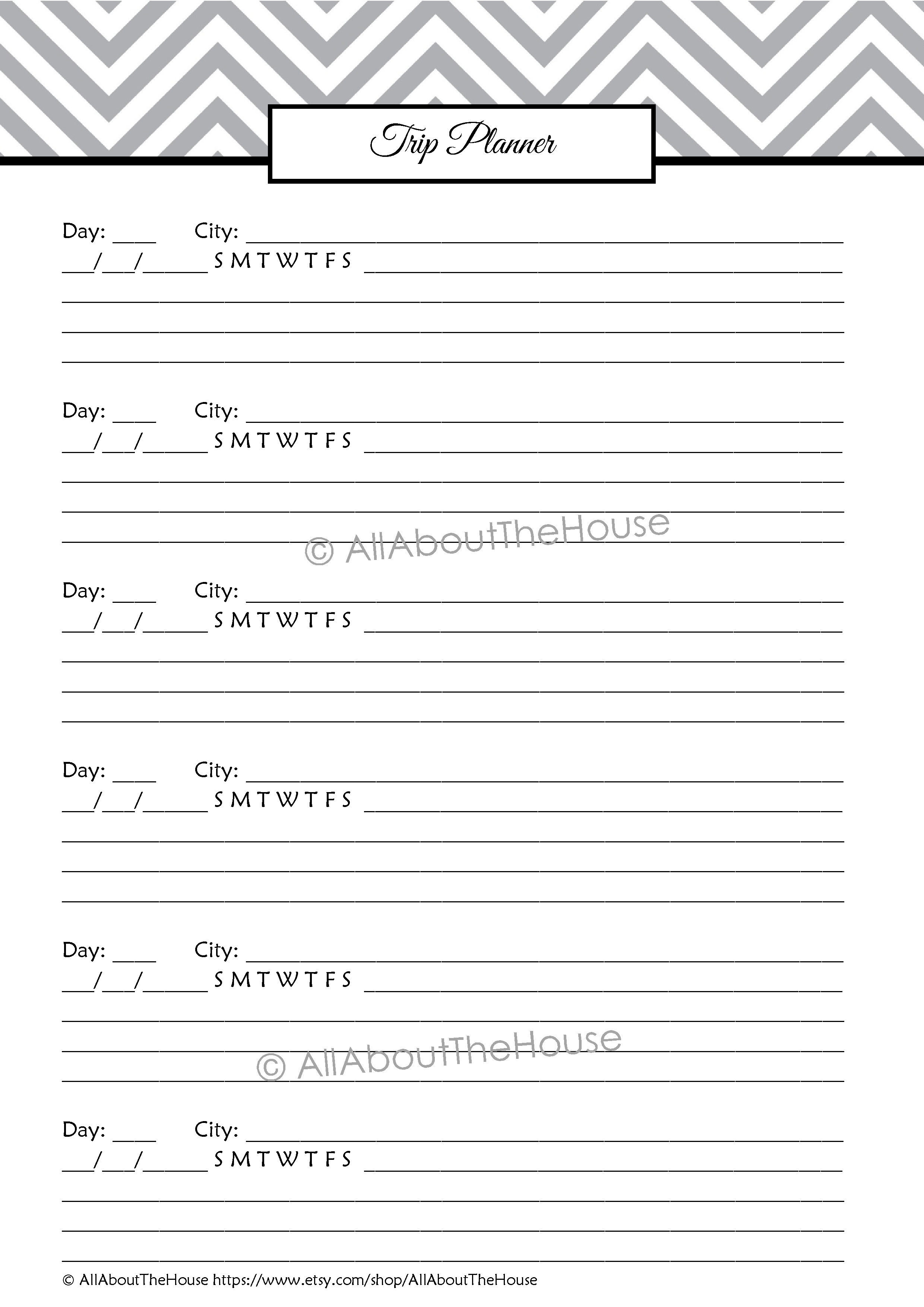

Travel Planning Kit EDITABLE AllAboutTheHouse Printables

Ultimate Walt Disney World Vacation Planner A5 Size

Vacation Trip Planning Checklist to help you stay

Travel printable vacation planner yearly trip planner trip

Vacation Trip Budget Planner Travel budget planner

Vacation Planning Printable Pack Organizing Homelife

Travel Planning Kit Vacation Planner Travel Planner Etsy

Free Printable Vacation Clothing Planner DayNight

Printable Route Planner planner template free

Travel Planner Printable Jessica Marie Design

DisneyLand Trip Planner Binder Starter Set for 9 Day

Belum ada Komentar untuk "Vacation Trip Planner"

Posting Komentar